Last Updated: May 2023 (Logistics)

Logistics

This article deals with ‘Logistics – UPSC.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

What is Logistics?

Logistics means managing the flow of goods between the point of origin and the point of consumption.

It includes

- Transportation

- Inventory management

- Warehousing

- Packaging

- Last-mile delivery

Importance of the Logistics Sector

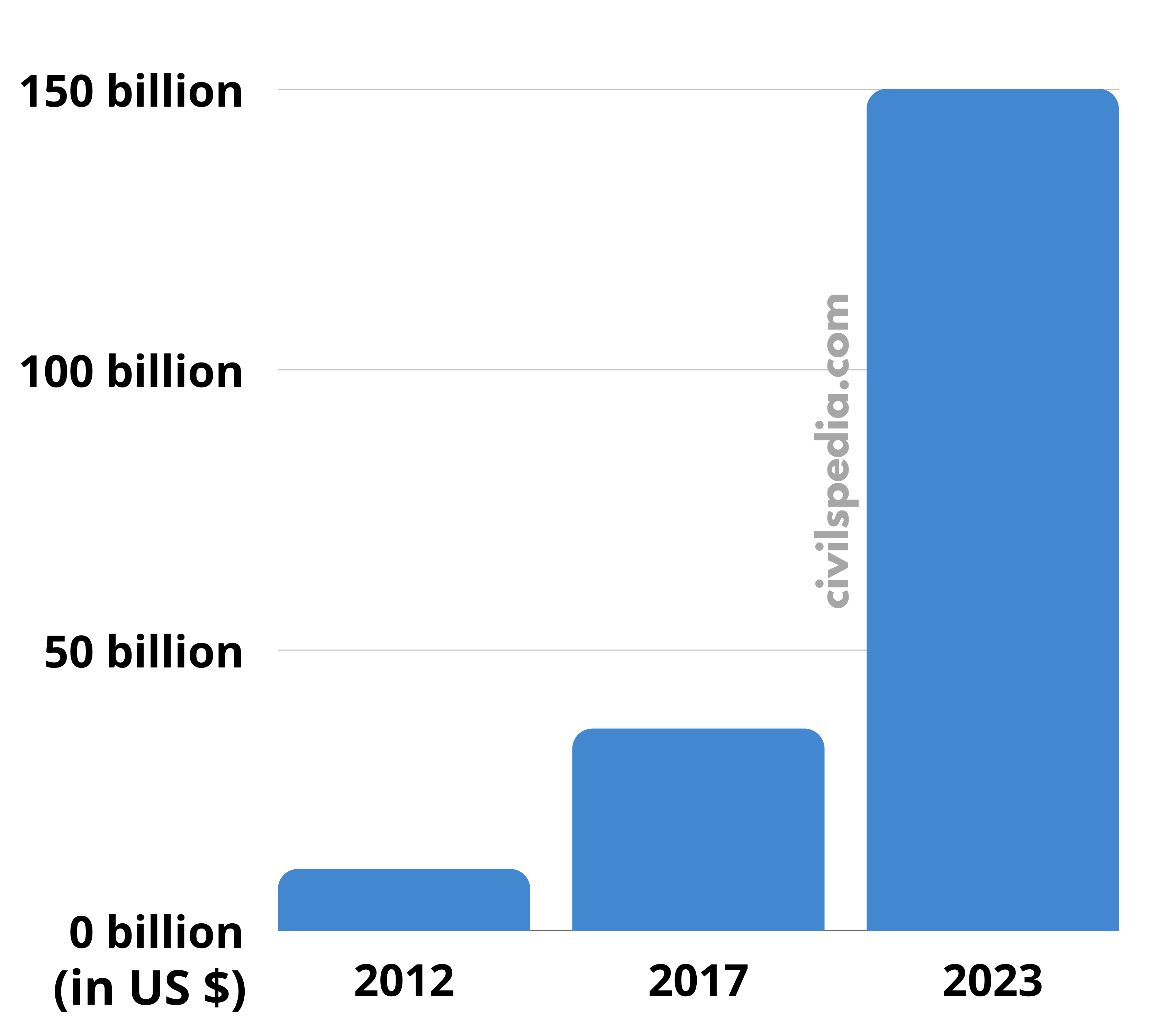

- Sunrise Sector: The Indian logistics sector is valued at $215 billion and is expected to grow at a CAGR of 10.5% between 2019 and 2025.

- Employment: Logistics industry employs 4.5 crores and is growing at the rate of 15%.

- The growth of the manufacturing sector depends upon it. E.g., getting raw material, taking final goods to markets etc.

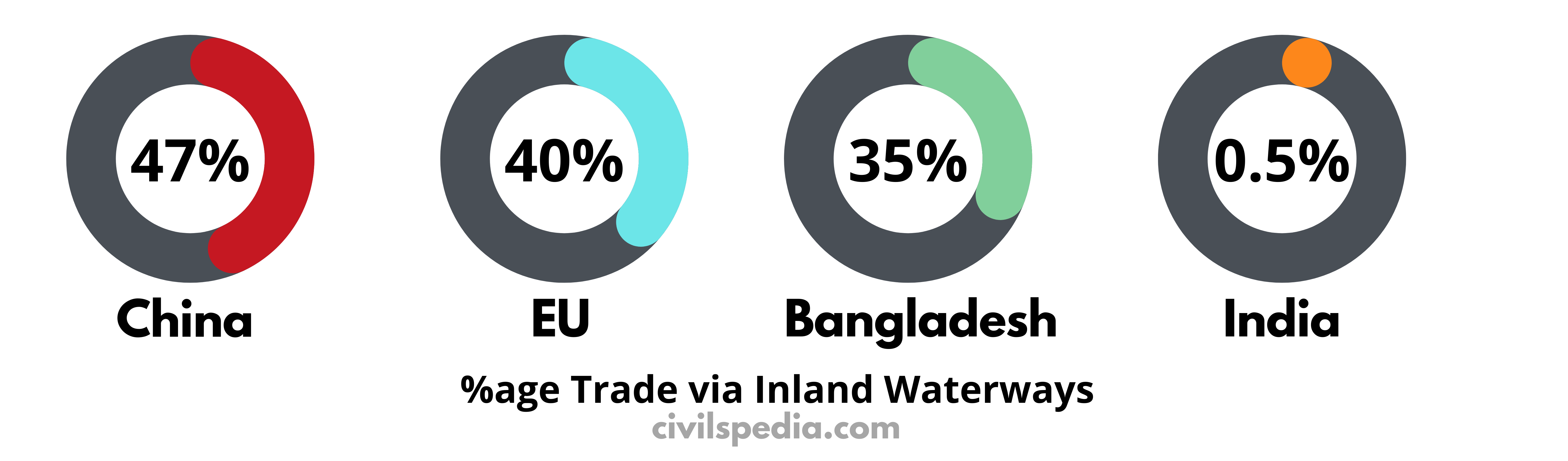

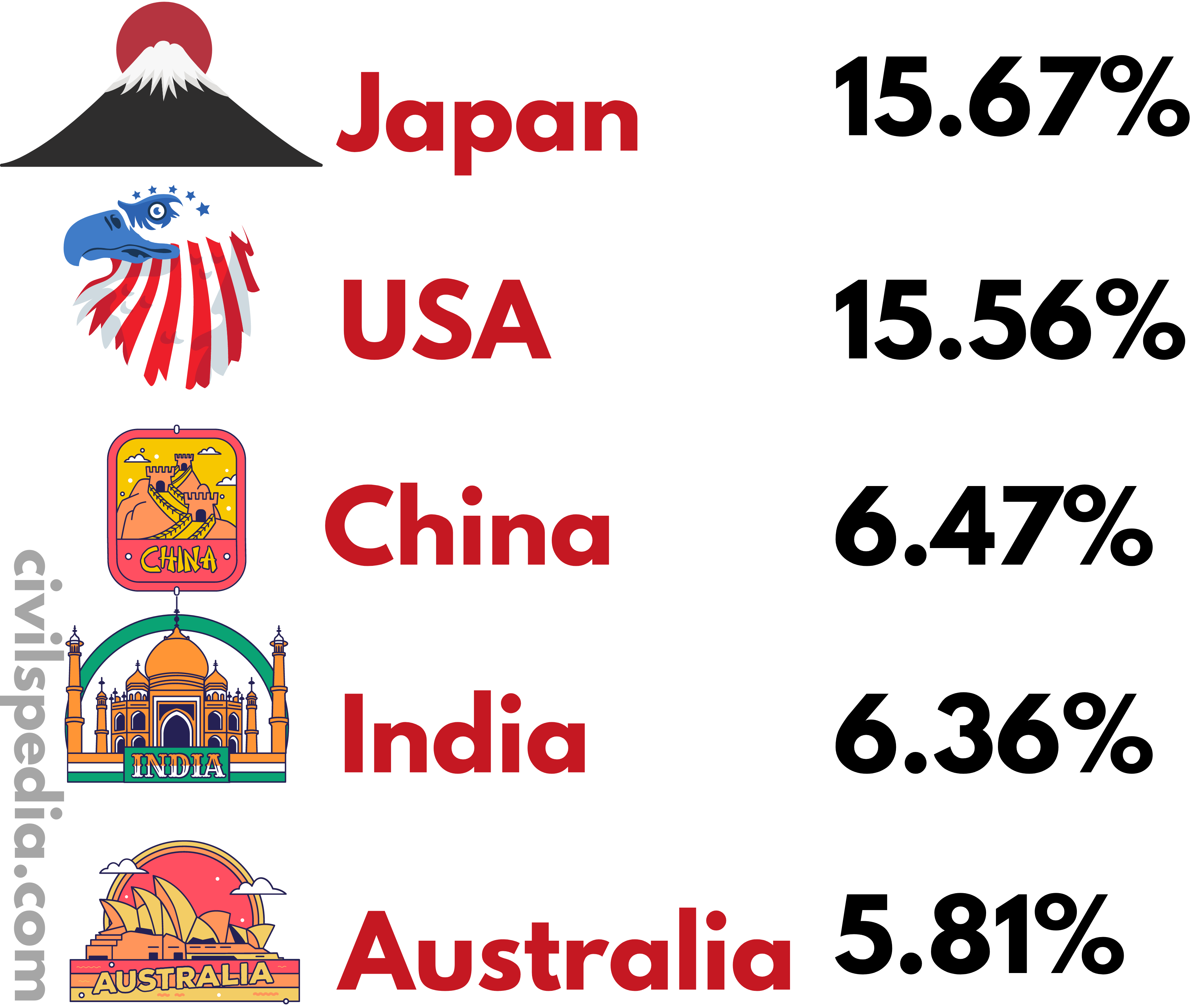

- Boosting Indian Exports: China is an export giant because of its highly efficient logistics.

- Service Sector: Amazon, Flipkart etc., have become giants due to their efficient logistics.

- Increasing Farmer’s Income: An efficient logistic supply chain network has the potential to increase farmers’ income manifold, which can lead to a domino effect on the overall economy.

Challenges

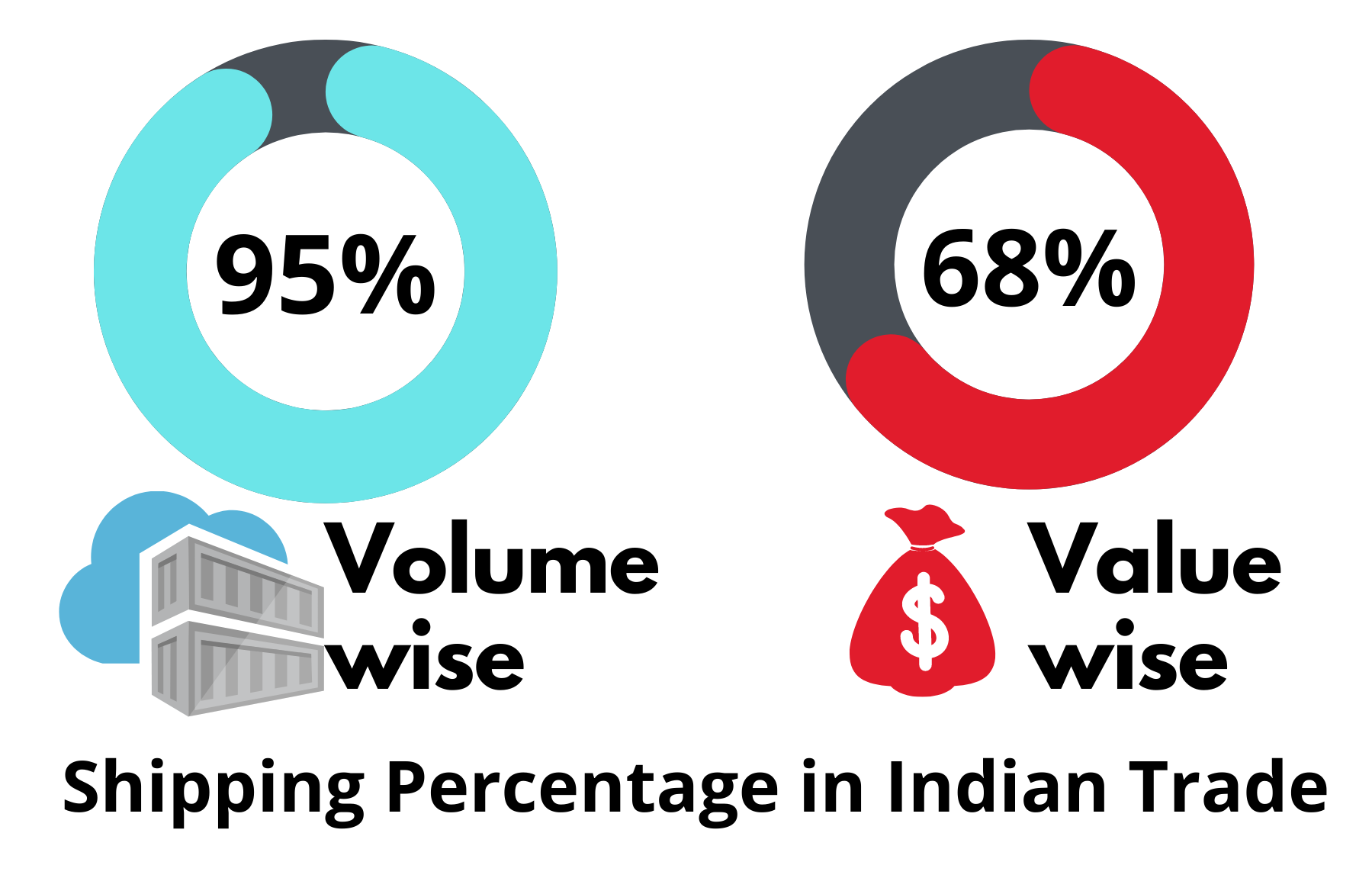

- High Cost: India’s logistics costs are 4-5 times that of developed countries. It makes our products uncompetitive.

- Inefficient: Logistics in India is inefficient compared to China. It takes more time to reach a product in the western market—days to send the product to the US – 14 days from China compared to 41 from Delhi.

- Regulatory Issues: There are obstacles in land acquisition and consolidation, poor coordination among multiple regulatory agencies and a lack of transparency in compliances.

- Warehouse Issues: The inadequate size of the warehouse, difficulty in getting land at the desired location, and the majority of warehouses are not leakproof.

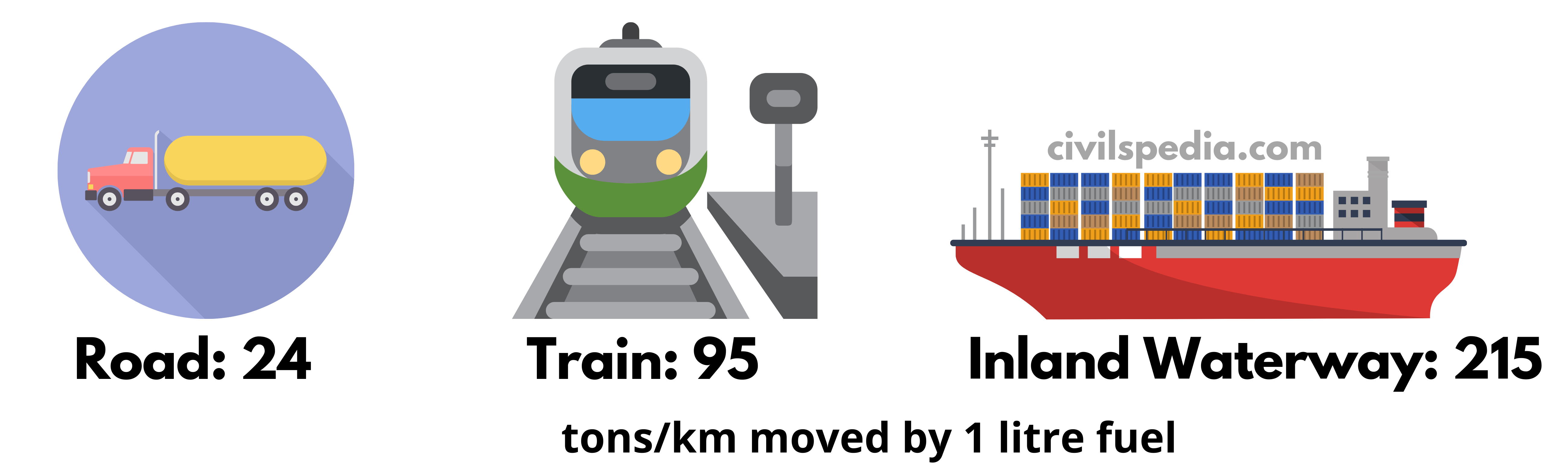

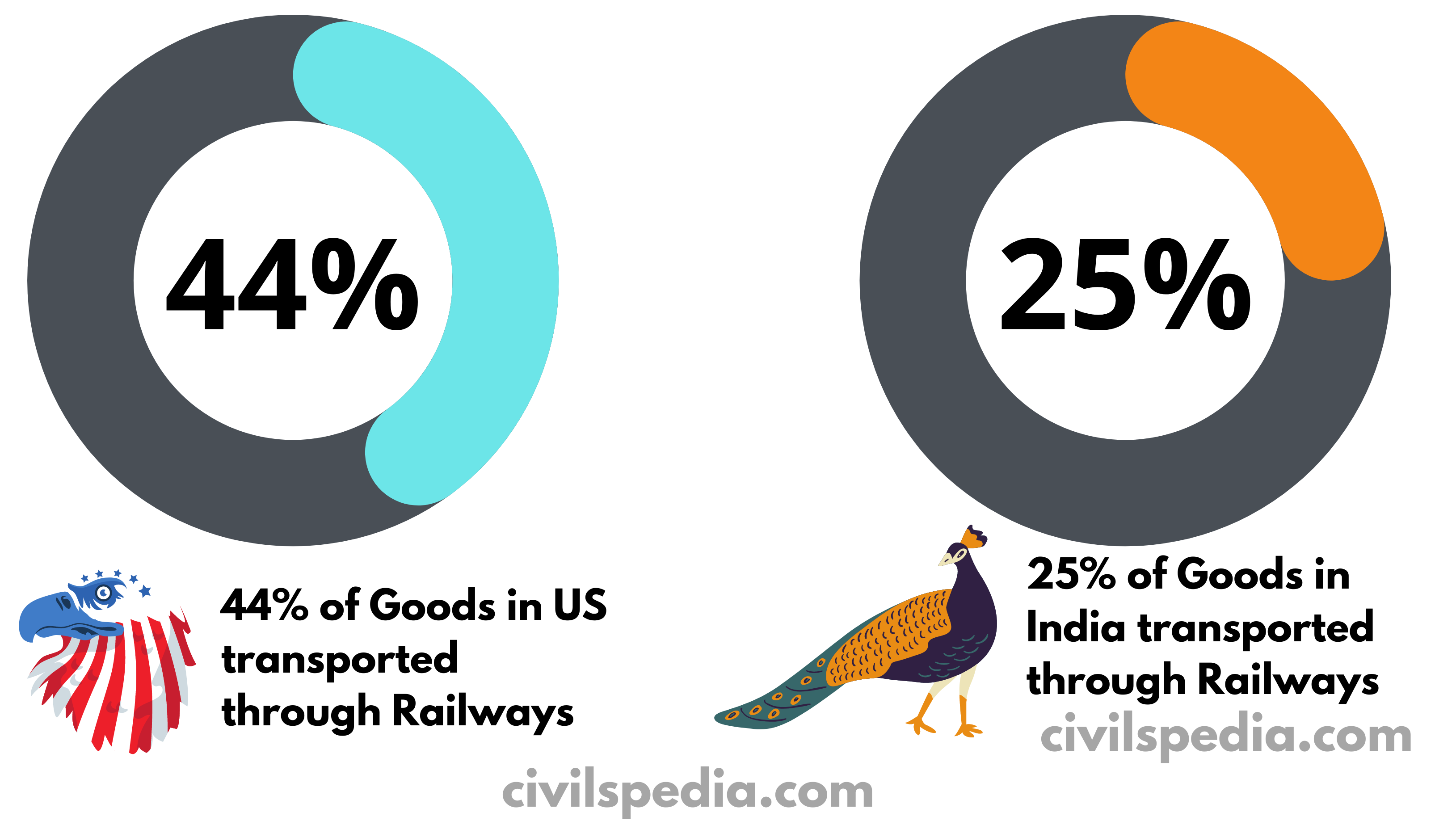

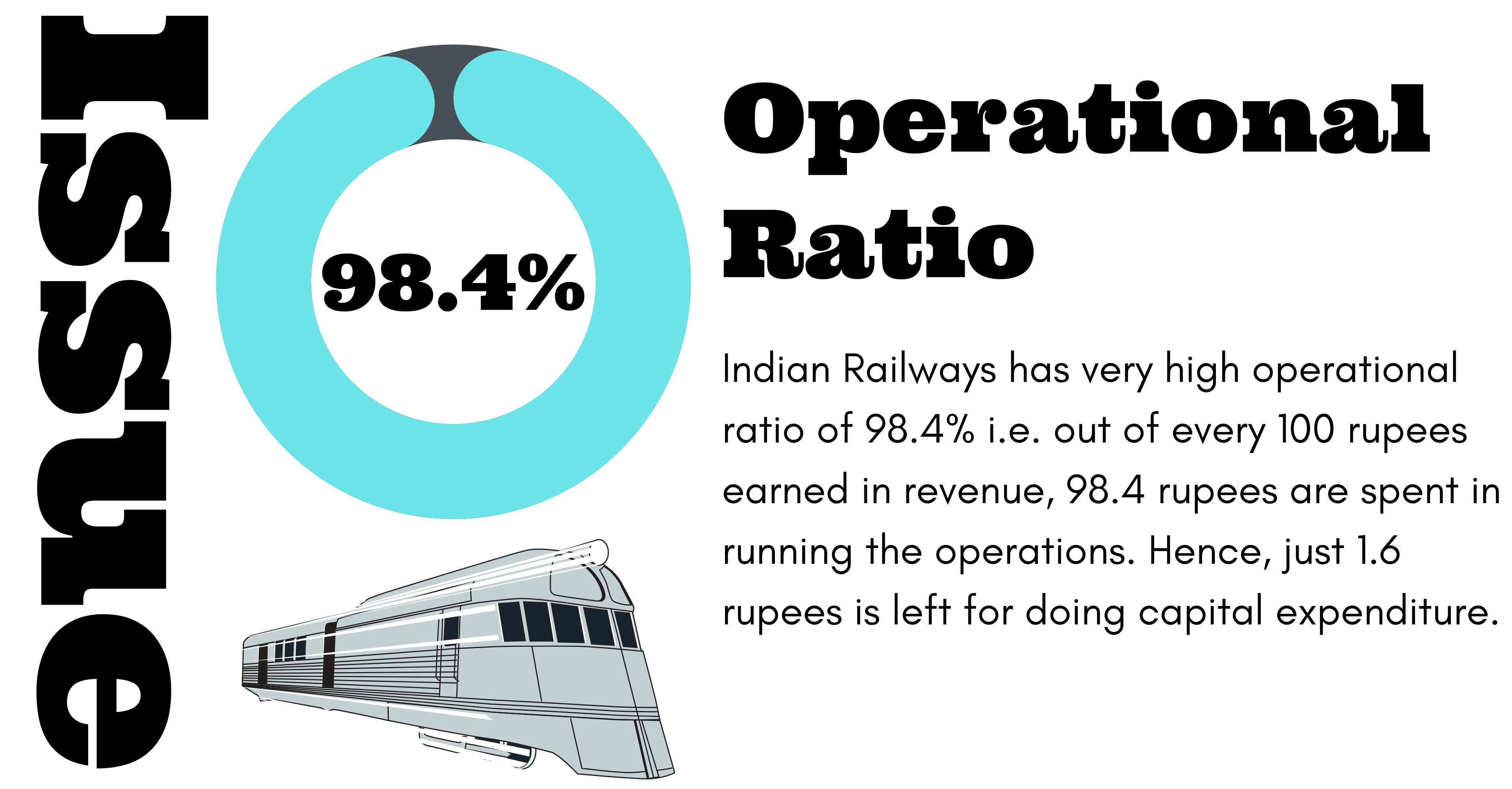

- Saturated Transport: Railways and roads have been saturated. The railway is operating at 120% of its capacity leading to delays.

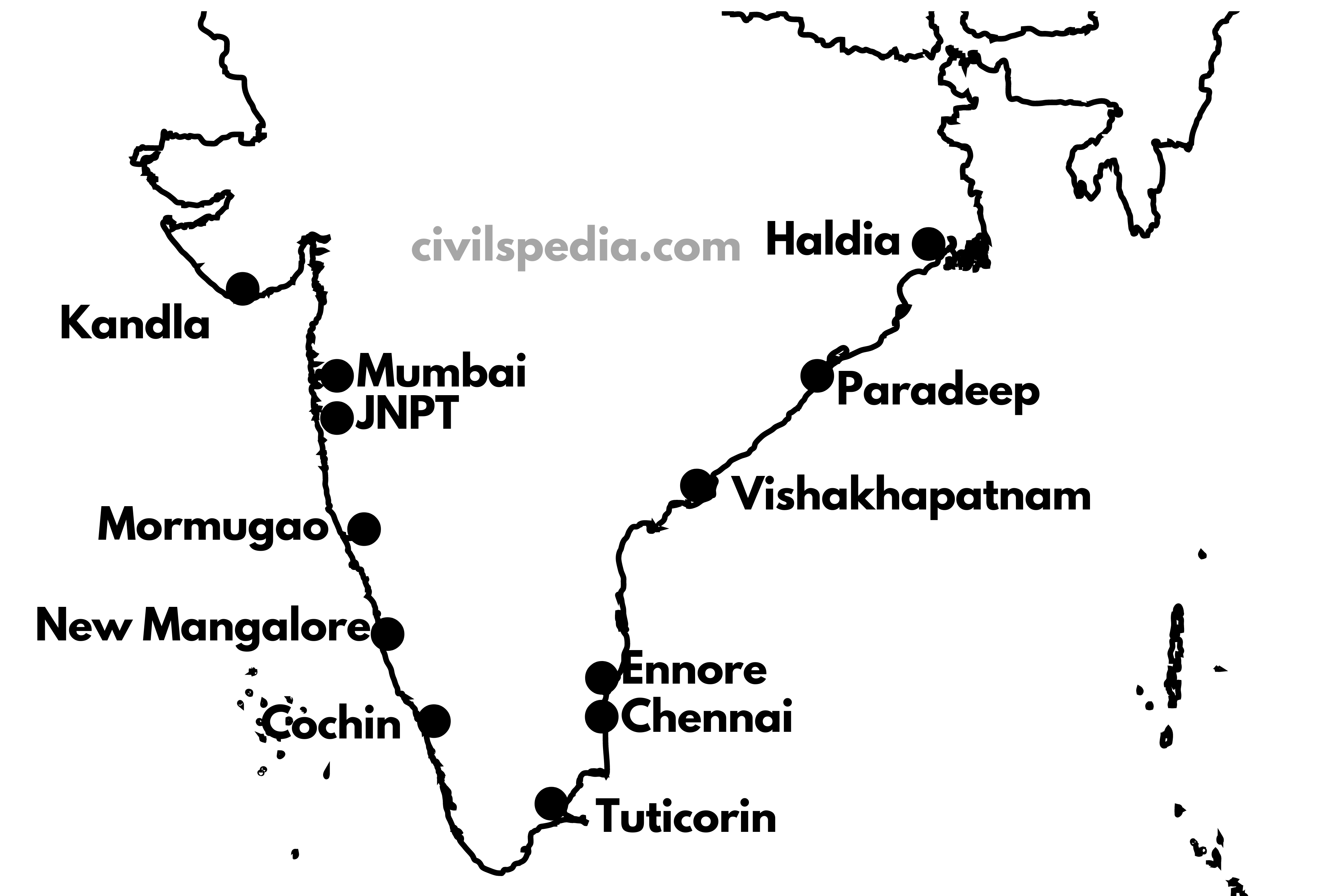

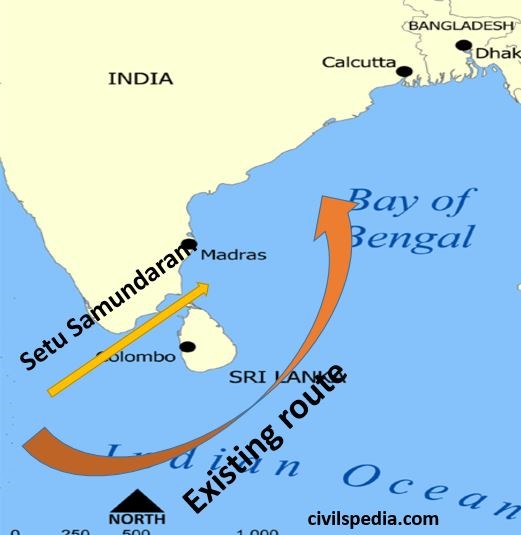

- Ports: Large vessels cant enter Indian ports. Hence, Indian cargo is first taken to Colombo or another port & transhipped from there.

- Rural market: Logistics industry is least developed to cater to rural areas, which form a large chunk of the Indian market.

- Lack of inter-ministerial coordination / Fragmented Policy: It hampers smooth multimodal transport in India.

- Shortage of skilled workforce: Non-availability of skilled manpower is attributed to inadequate training and proper leadership and support. There are limited institutes for soft skills and operational and technical training. Also, due to poor working conditions and low pay scale (unorganized nature), it is not a preferred choice among skilled personnel.

Due to these challenges, India’s rank on World Bank’s Logistics Performance Index is low.

Steps taken by the Government to improve logistics

PM Gati Shakti

- The growth experience of advanced economies has highlighted the importance of having a multimodal transport network approach. To introduce holistic planning in the case of infrastructure projects, the government launched PM Gati Shakti.

How will it work?

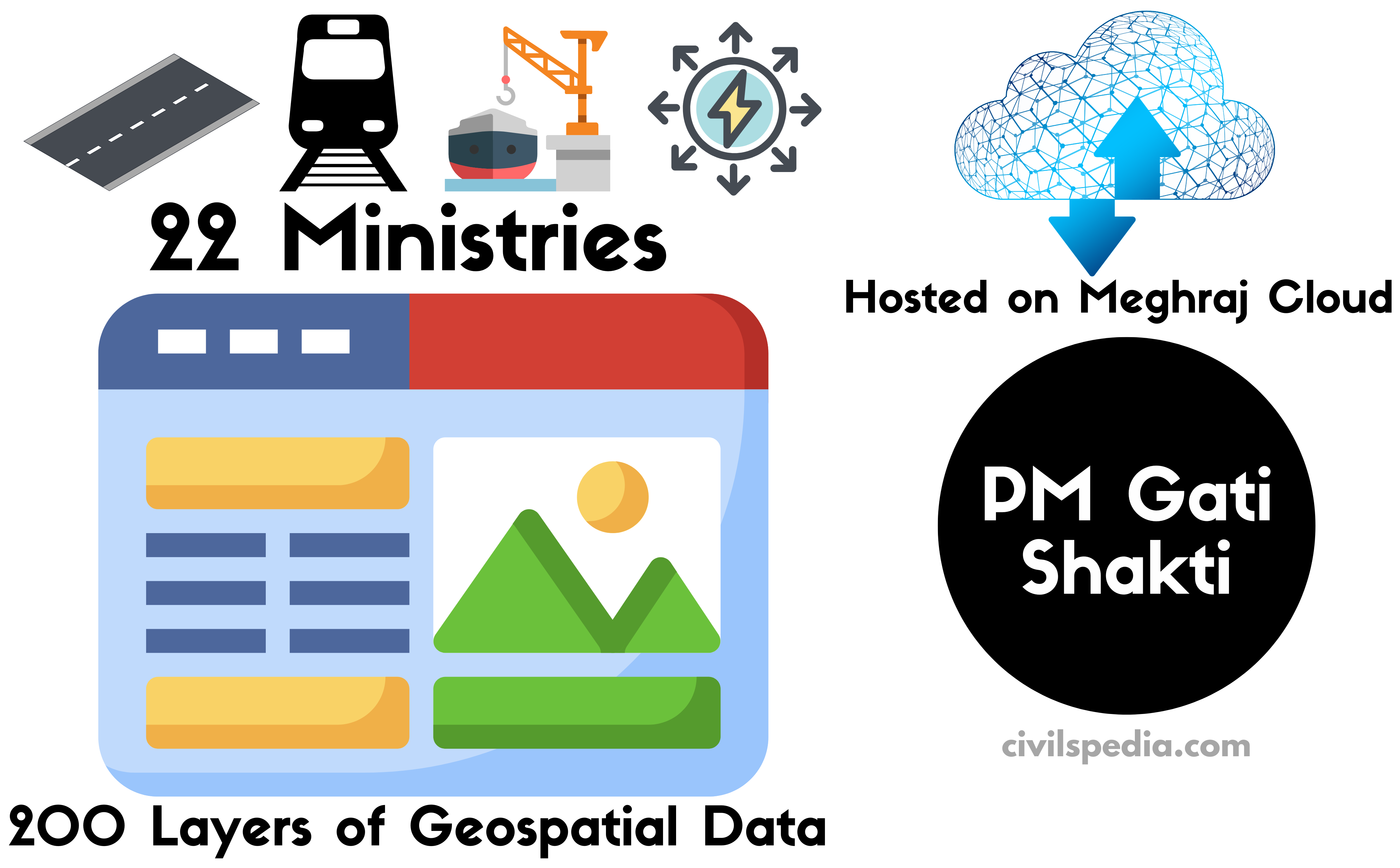

- PM Gati Shakti is a digital platform which connects 22 ministries, such as Road, Shipping, Aviation, Railways, Petroleum, Telecom etc., to ensure holistic planning and execution of projects.

- The platform has 200 layers of geospatial data, such as roads, railways, forests, rivers, state and district boundaries, etc., to aid in planning projects and obtaining rapid clearances.

- The Gati Shakti portal will also help government agencies to track the real-time development of various infrastructural projects from a centralized place.

- It has been developed by the Bhaskaracharya National Institute for Space Applications and Geo-informatics (BISAG-N) and hosted securely on the Meghraj cloud.

Benefits

- Address the silos-based approach of infrastructure development by various ministries.

- Reduce the logistics cost in India.

National Logistics Policy (NLP)

- The NLP policy aims to increase employment opportunities, boost economic growth, and promote the competitiveness of Indian goods in global markets. It aims to bring global standards to warehousing, multimodal digital integration, ease of logistics services, human resources, and skill enhancement.

- The targets of NLP are

- Reduce the cost of logistics: Target is to reduce the cost of logistics to global benchmarks by 2030.

- Improve India’s Logistics Performance Index ranking: Target will be in the top 25 ranks by 2030.

- Create a data-driven decision support mechanism for an efficient logistics ecosystem.

- It will be achieved via a Comprehensive Logistics Action Plan (CLAP) consisting of

- Unified Logistics Interface Platform: It will bring all digital services related to transportation to a single portal.

- Standardisation of physical assets and benchmarking of service quality standards

- Development of Logistics Human Resources

- Facilitation of Logistics Parks

- Development of Export-Import (EXIM) Logistics

Infrastructure Lending Status:

Logistics sector has been given Infrastructure Lending Status. Due to this, loans for logistics have become eligible for the following benefits.

- Logistics projects can get long tenure loans.

- Loans will be cheaper (at least 50 basis points)

- Such projects will now be eligible to borrow from specialized lenders like IDFC, IIFCL etc., which fund only infrastructure projects.

- Attracting investments from debt, pension funds and international lenders (ECBs) into recognized projects.

Other Steps

- GST Tax Reforms: The taxation system has become simple and has created a single market.

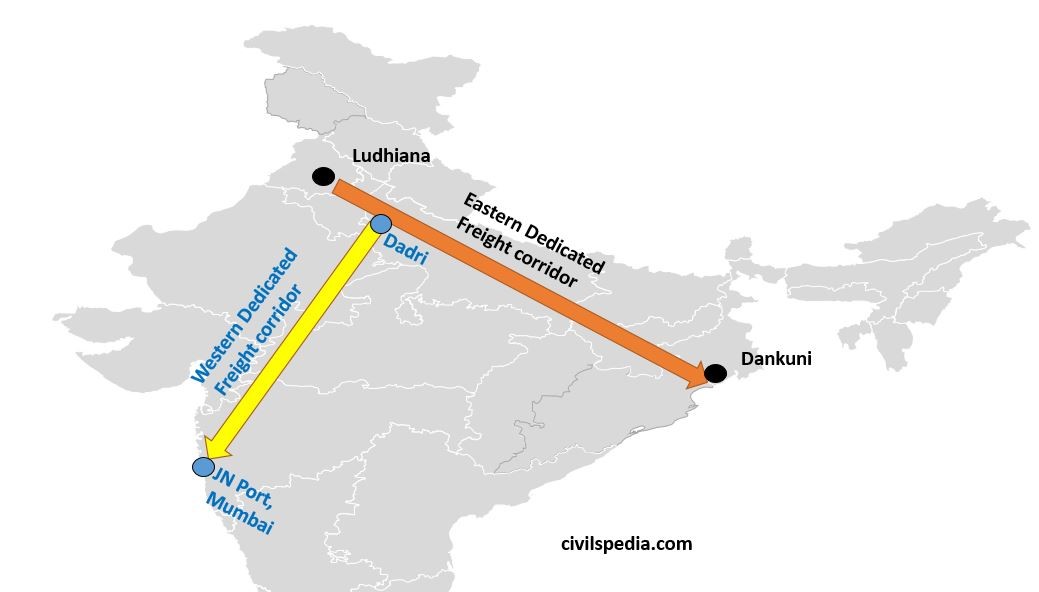

- Dedicated Freight corridors will smoothen the transportation and logistics.

- Sagarmala and Bharatmala projects have been started to upgrade port and road infrastructure.

- India has signed the Trade Facilitation Agreement of WTO and taken steps to make customs procedures smooth and paperless.

- Creation of Logistics Division: The Logistics division in the Department of Commerce has been created. Further, the Logistics division has planned to create an IT backbone and develop a National Logistics Information Portal. This online Logistics marketplace will bring together the various stakeholders on a single platform.

- Logistics Ease Across Different States (LEADS) Index: LEADS Index is an attempt to establish the baseline of performance in the logistics sector based on the perception of users and stakeholders at the state level.

- Logistic Enhance Efficiency Program: It was launched to manage and develop logistic parks and reduce the cost of logistics.

What more can be done?

- Formulation of National Integrated Logistics Policy to bring greater transparency and enhance efficiency

- Faster clearances for setting up of logistics infrastructure like Multimodal logistic parks (MMLPs), Container Freight Station (CFS), Air Freight Station (AFS) & Inland Container Depot (ICD)

- Promote the introduction of high-end technologies like high-tech scanning equipment, RFID, GPS, EDI, and online Track & Trace systems in the entire logistics network.

Multimodal Projects

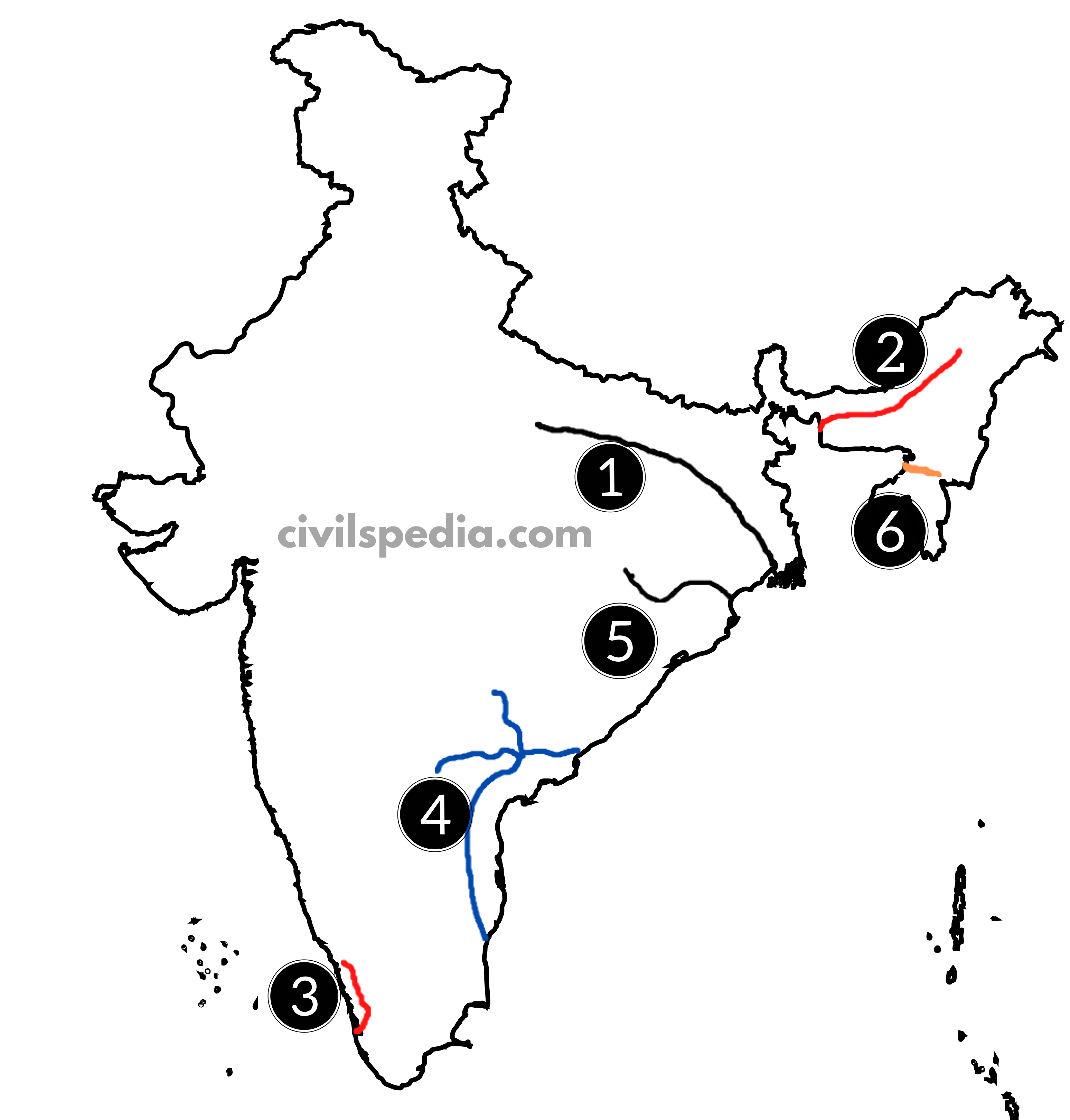

Integrated Multimodal Transportation System (IMTS) serves to interconnect different modes of transport – road, rail, air, and water – seamlessly and therefore improve the efficiency and speed of goods and passengers movement.

In 2022, the Government awarded the contract for setting up India’s first multi-modal logistics park (MMLP) near Chennai to Reliance Industries (RIL). India is planning to build 35 MMLPs

Benefits

- In difficult terrain, Multimodal Transport is better suited. E.g. Kaladan Multimodal Project uses Road, Inland Transportation and Sea.

- Ease in the movement of goods => Embedded cost of transportation in goods can be cut down.

- The multiplier effect on the economy: They lead to the development of ancillary industries like Steel, Shipbuilding, Railway building etc.

- International Relations: Our trade in South East Asia can grow with the development of Multimodal Projects in those areas.

- Provides faster transit of goods

- Reduces the burden of documentation and formalities

- Establishes only one agency to deal with.

Challenges

- Coordination Issues: Different Ministries and agencies, both of Union and state, need to come on a single platform

- Land acquisition issues

- Maintenance of all the modes of transportation simultaneously is an issue.

- Finance Issues: It requires huge investment.

Scheme: Multi-Modal Logistics Park (MMLP)

- Multi-Modal Logistics Park (MMLP) is a modal freight handling establishment comprising warehouses, dedicated cold chain facilities, freight or container terminals and bulk cargo terminals, which eases and optimizes merchandise movement via road, rail, waterway and air, and consequently, rationalizes the cost of logistics and improves the competitiveness of logistics.

- India is developing 35 MMLPs across India over the coming years. The first MMLP will be constructed in Assam at a cost of $407 million.