Last Updated: May 2023 (Tourism (UPSC Notes))

Tourism (UPSC Notes)

This article deals with ‘Tourism (UPSC Notes).’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

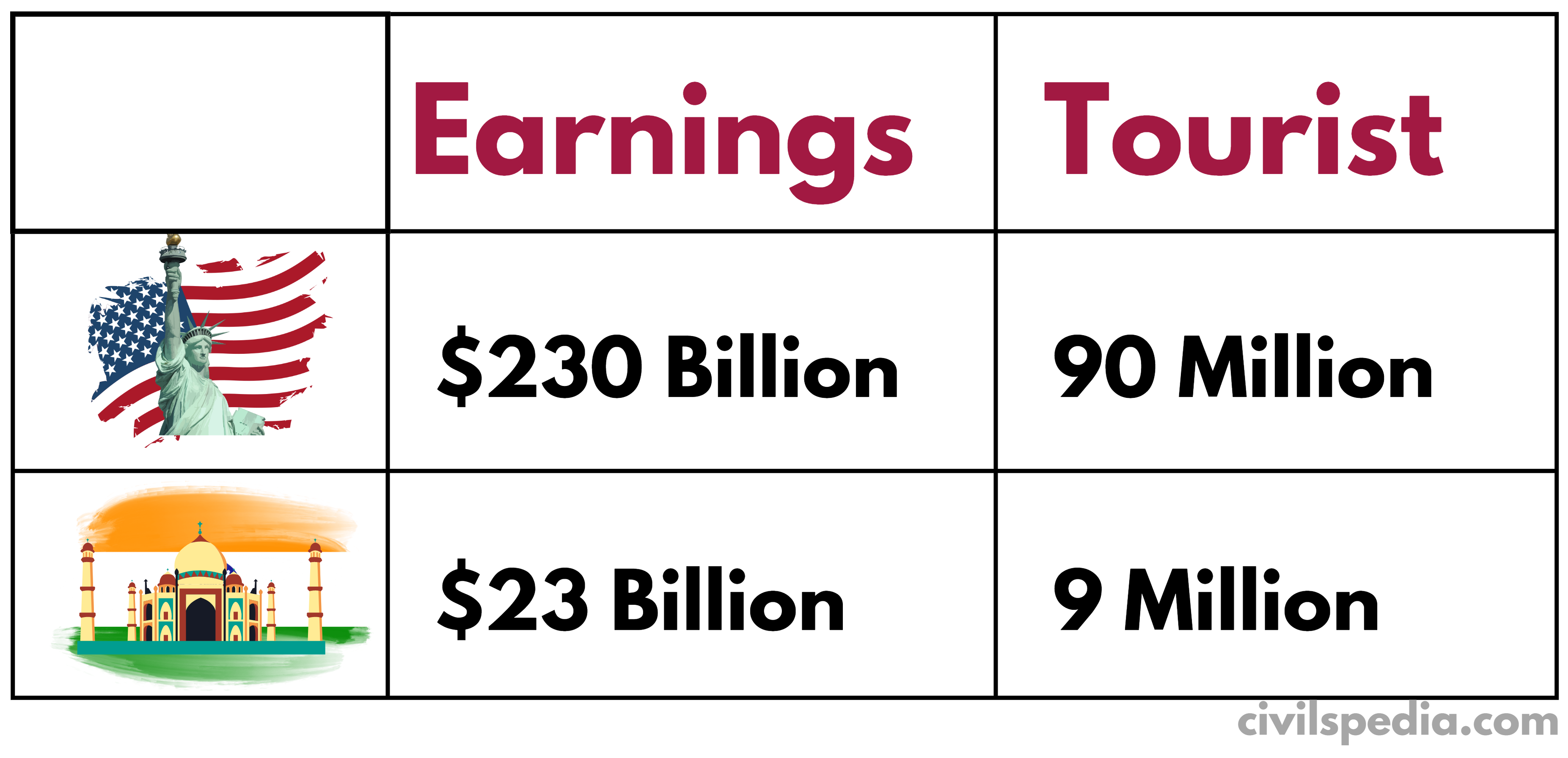

- India is ranked 10th in terms of t tourism’s total contribution to GDP, contributing 4.7% to total GDP.

- It is a labor-intensive sector, accounting for 39 million jobs (2020) and significantly impacts trade, investment, social inclusion, etc.

- But India has not been able to exploit the potential of tourism to full capacity (corroborated by India vs. USA)

Hence, India has vast untapped potential in the tourism sector

Potential of Tourism in India

- Large Diversity in Landscape: India’s landscape can cater to almost every type of traveller, whether they are seeking adventure, wellness, culture and heritage or cuisines.

- Ancient Civilisation: India is an ancient civilization, and a number of historical places and buildings have tremendous potential to draw tourists. E.g., Hampi, Khajuraho, Agra, Delhi, Madurai etc.

- Religious Tourism: India is home to a large number of religions. Hinduism, Sikhism and Buddhism took birth here.

- Huge Labour Available: The availability of a huge labour force, both skilled and unskilled, can act as a catalyst.

- Medical Tourism: India can provide specialized treatments at the cost of 1/4th that of developed countries. Target countries include Central Asia, Neighbours like Bangladesh, Sri Lanka etc.

- MICE (Meeting, Incentive, Conferences & Exhibitions): It is a specialized niche of business tourism. Indian MICE Tourism potential is pegged at 25,000 crore due to Places like Pragati Maidan Delhi (for exhibition) and institutes like IITs, AIIMS, IIMs etc., for International Conferences.

Reasons for untapped Tourism Potential

- The tourism industry is closely integrated with several other industries like the hotel industry, accommodation, aviation, railway, roadways, healthcare, entertainment etc. The combined weaknesses of all the sectors make Indian Tourism more vulnerable.

- Negative perceptions, such as India being unsafe for female foreign tourists and lack of hygiene, negatively impact Indian tourism.

- Governance Issue :

- Government is unable to make schemes to attract tourists like Buddhist Tourists who have cultural ties with India.

- No advertisement campaigns like Malaysian and Singapore Tourism are run in foreign countries.

- Lack of automated immigration procedures like Visa on Arrival.

- Limited professionalism in people involved in the tourism sector, like tourist guides

- Insurgency in potential Tourist Spots: Tourist places like Kashmir and North East are hit by insurgency, impacting tourism potential.

Schemes to Promote Tourism in India

In the last two years, the Ministry of Tourism has taken many steps to make India an attractive destination.

- PRASAD Scheme: To develop tourism infrastructure in and around famous religious and pilgrimage cities. (12 cities Ajmer, Amritsar, Amravati, Dwarka, Gaya, Kamakhaya, Kancheepuram, Kedarnath, Mathura, Patna, Puri, Varanasi and Velankanni)

- HRIDAY: For holistic development of Heritage cities (12 identified Cities, namely, Ajmer, Amaravati, Amritsar, Badami, Dwarka, Gaya, Kanchipuram, Mathura, Puri, Varanasi, Velankanni and Warangal.)

- Swadesh Darshan Scheme: It aims to develop a theme-based tourist circuit. These circuits include North-East India Circuit, Buddhist Circuit, Himalayan Circuit, Coastal Circuit, Krishna Circuit, Desert Circuit, Tribal Circuit, Eco Circuit, Wildlife Circuit, Rural Circuit, Spiritual Circuit, Ramayana Circuit and Heritage Circuit.

- Adopt a Heritage: Corporate Houses will adopt a Heritage and develop their infrastructure. E.g., Dalmia Group adopted Red Fort for ₹ 25 Crore, and they will provide basic amenities and develop infrastructure.

- E-visa process simplified: Nationals of 161 countries have been allowed visits for business and medical treatment. Additionally, a special visa category called ‘Medical Visa’ & ‘Medical Attendant Visa‘ has been created to ease the entry of medical tourists into India

- The government is building a large number of museums to showcase Indian heritage and promote tourism.

- Incredible India Tourist Helpline: Multilingual helpline has been launched to provide assistance and information to tourists in 12 languages of the world, including Hindi & English

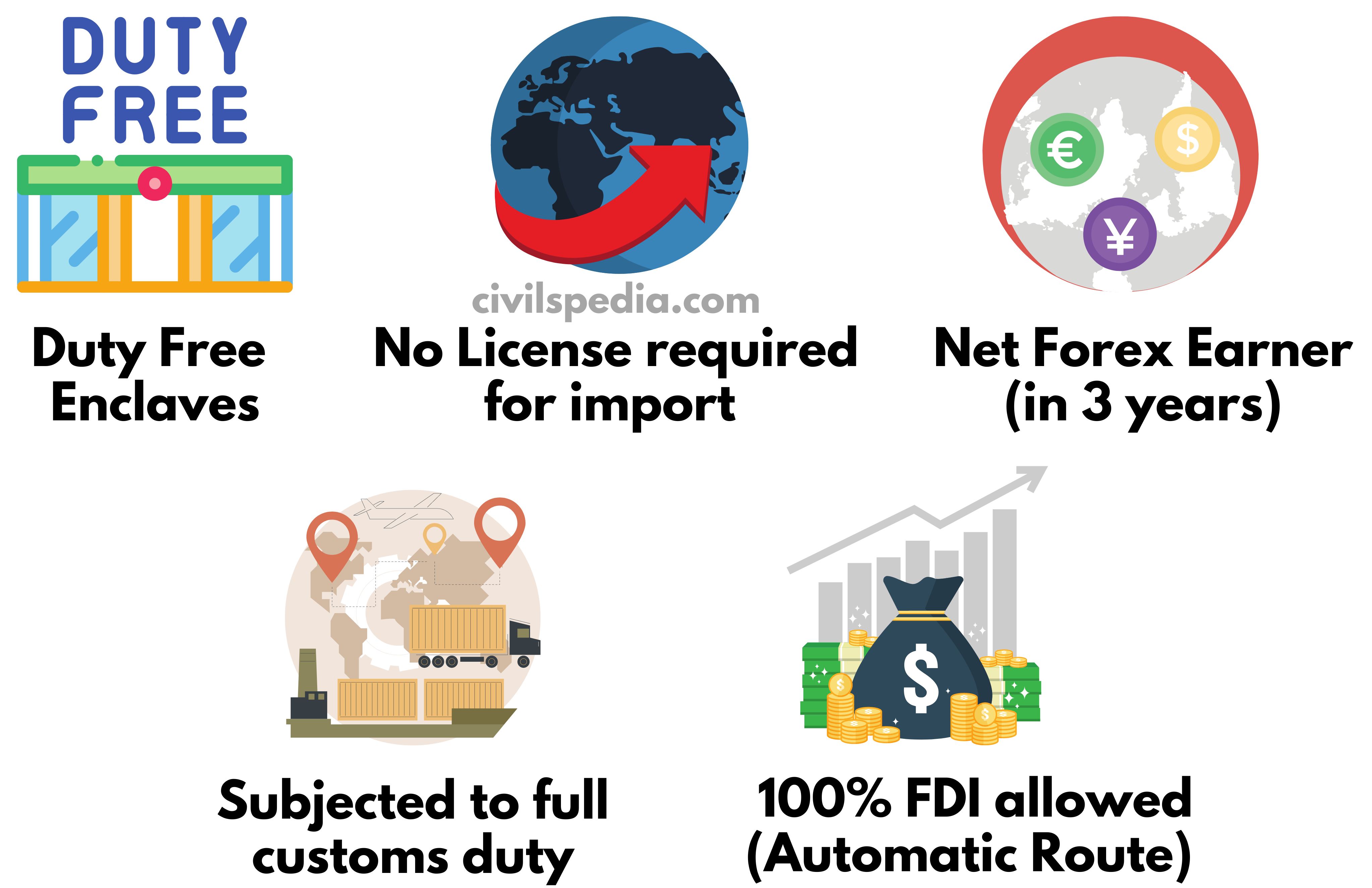

- 100 % FDI allowed in hotels, resorts & recreational activities

- Revamped schemes like Hunar se Ruzgar to give training to travel guides and Institutes of Hotel Management have been opened.

- State Specific

- Rajasthan has passed a bill under which misbehaviour with tourists has been made a cognizable offence. It is to prevent the touts from forcing tourists to buy things at exorbitant prices or fraudulating the tourists, as it impacts tourism negatively.