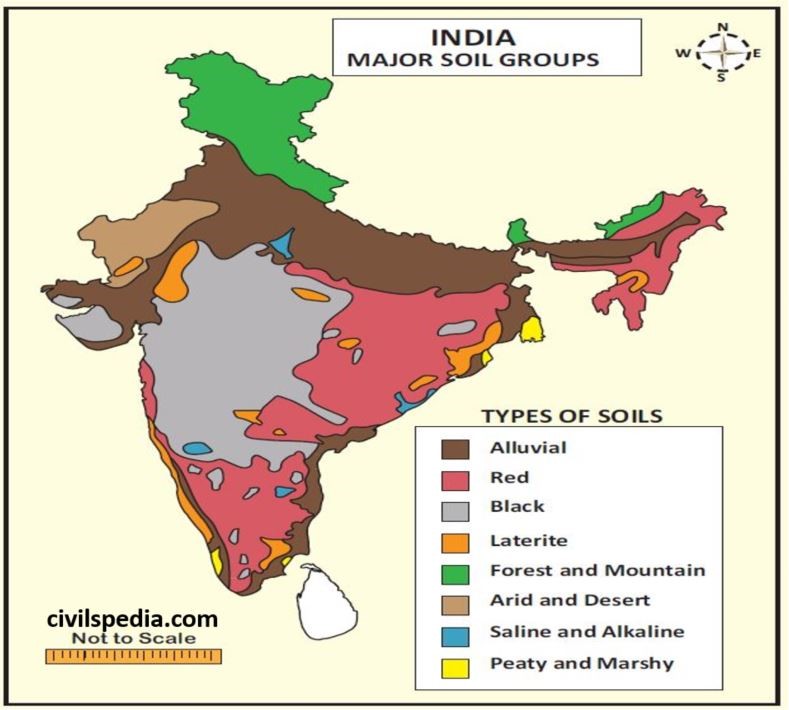

Soils of India

This article deals with ‘Soils of India ’ This is part of our series on ‘Geography’ which is an important pillar of the GS-1 syllabus. For more articles, you can click here

Introduction

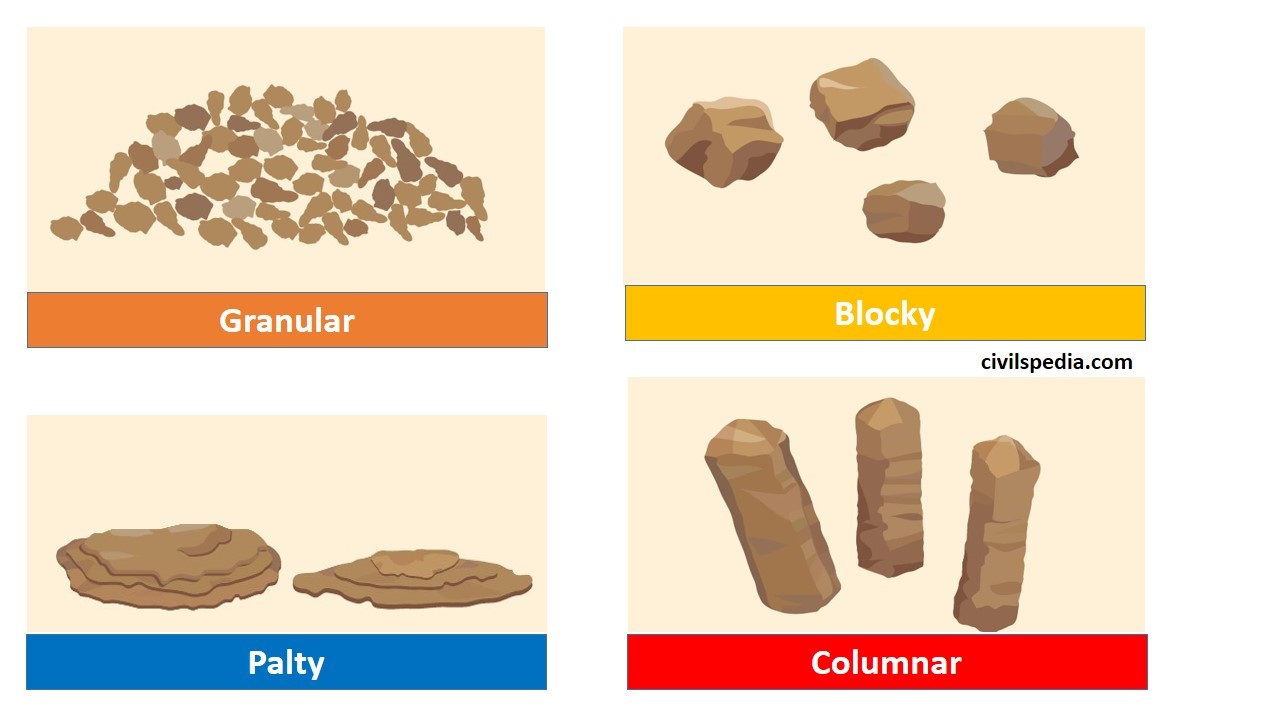

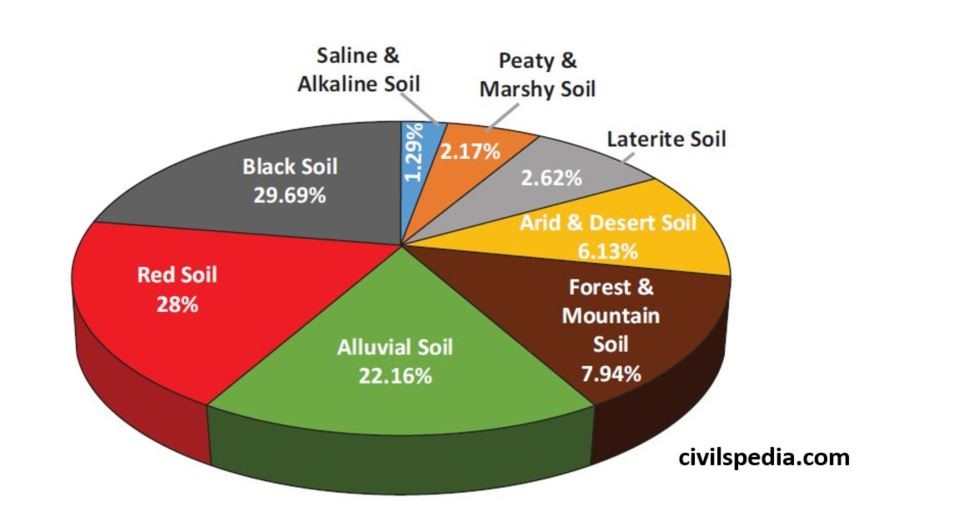

Indian Council of Agriculture Research (ICAR) divides the soils of India into the following eight major groups

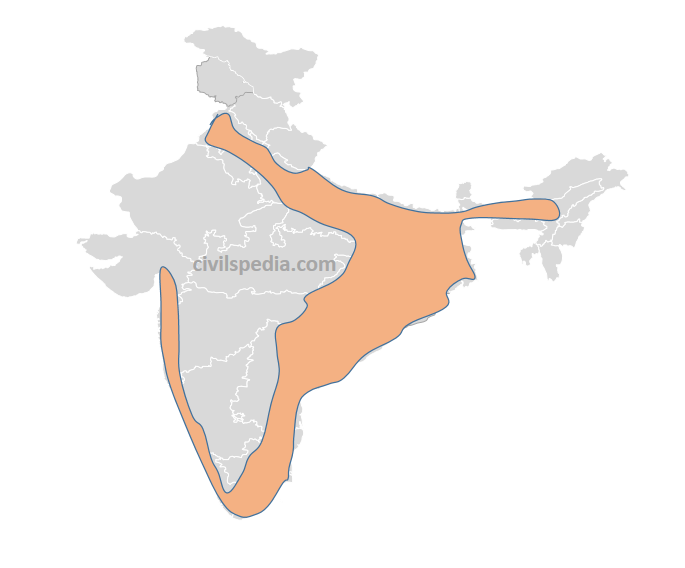

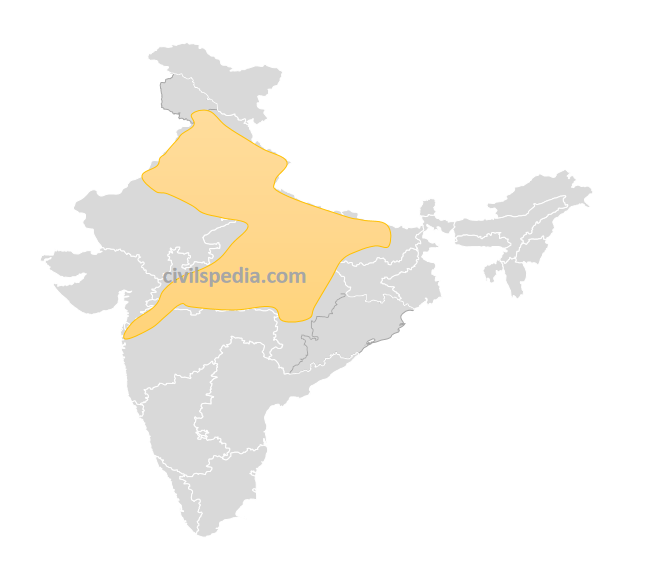

1. Alluvial Soil

- 22.16% of the total area of India consists of Alluvial soil.

- Alluvial soil formation results from the deposition of soil carried downstream by rivers originating from the Himalayas and southern plateau

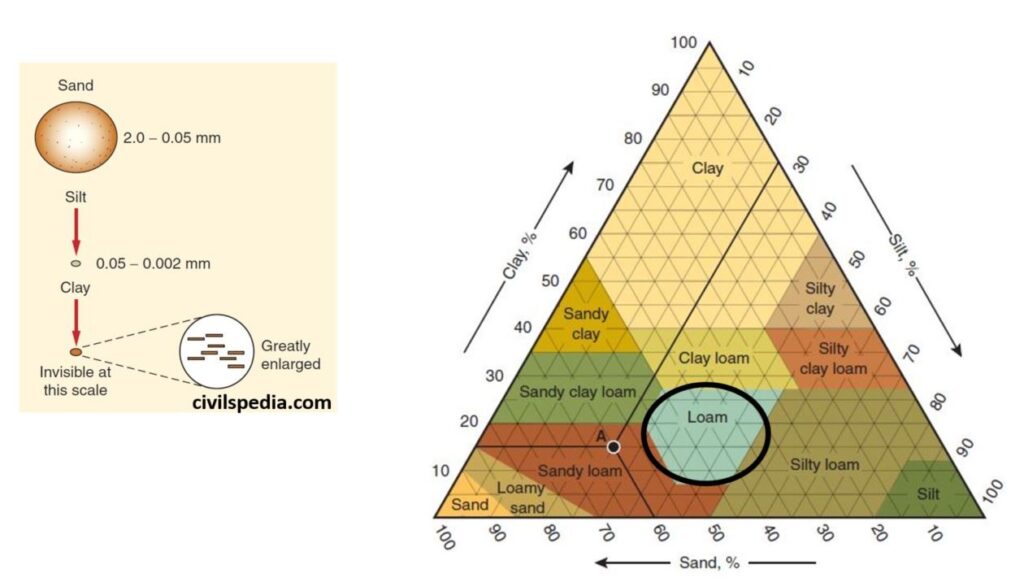

- Their texture is sandy loam to clay.

- Their colour varies from ash grey to light grey.

- Their profile shows no marked differentiation

- Chemical Composition

- These soils are rich in potash, phosphoric acid, lime and carbon compounds

- But they are deficient in nitrogen and humus. (they need urea for cultivation)

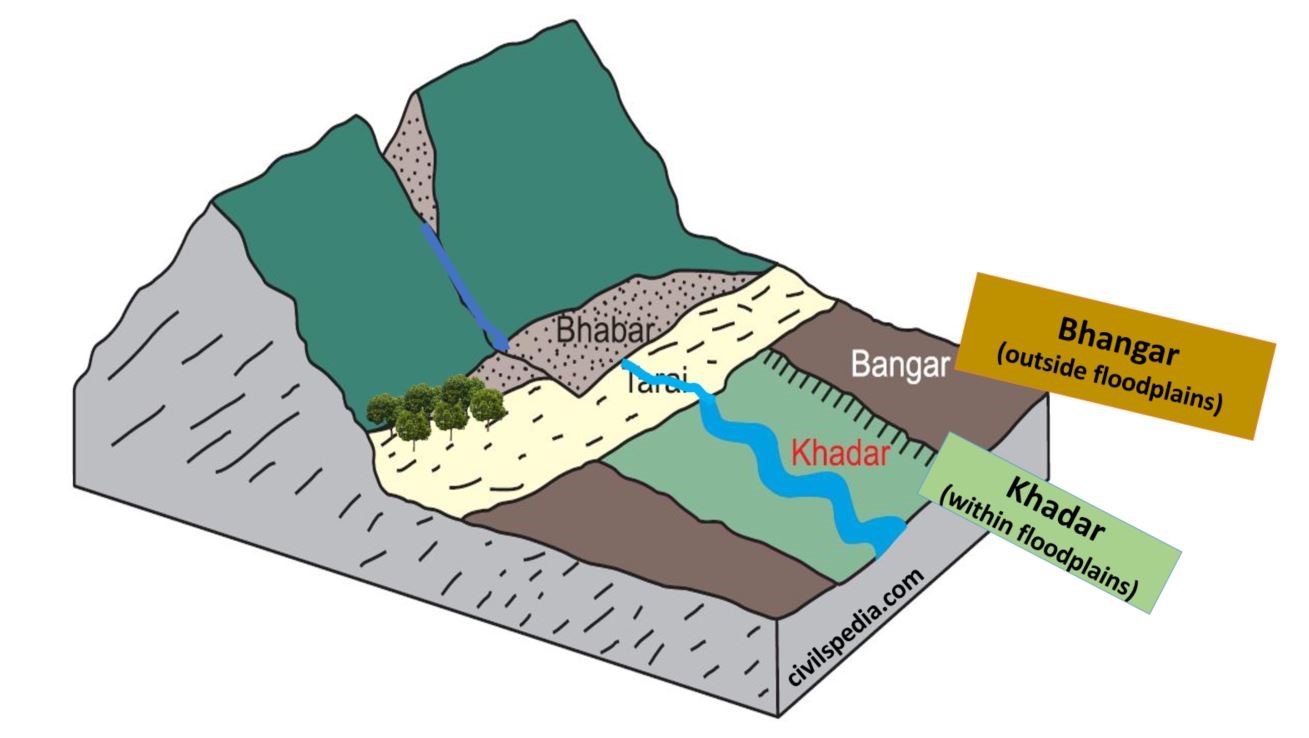

They are of two types

| Khadar | – Found in the floodplains of the rivers and contain fresh alluvial. – They are rich in kankar or nodules of impure CaCO3. |

| Bhangar | They are found well above flood plains and contain old alluvial |

- They are found in

- Plains of Ganga-Indus river valleys of Punjab, Haryana, Uttar Pradesh, Delhi, Eastern Rajasthan, Bihar, West Bengal

- Brahmaputra and Surma valleys of Assam

- Mahanadi valley of Orissa

- Narmada and Tapti valleys of Madhya Pradesh

- Deltaic areas of Godavari, Krishna and Cauvery in the South

- Crops grown in it includes Rice, Wheat, Sugarcane and Oilseeds

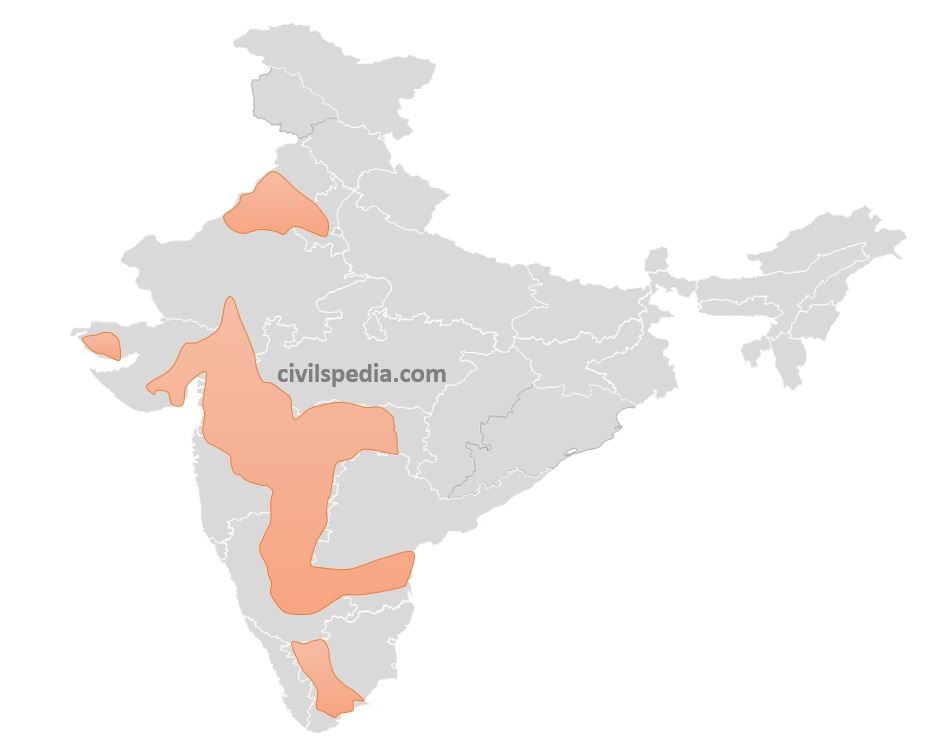

2. Black Soil

- 29.69% of the total area of India consists of black soil.

- They are also known as ‘Regur Soil’.

- Black soil has formed due to the disintegration of basalt volcanic rocks of the Deccan Traps.

- The black colour of these soils is due to the presence of iron and aluminium.

- Their texture is clayey.

- Chemical composition

- They are rich in iron, potash, aluminium, lime and magnesium.

- But they are deficient in nitrogen, phosphorus and organic matter.

- They have two unique properties.

- Self-Ploughing Nature: It has high clay content & as a result, cracks are developed when it is dry & becomes sticky when wet. Cracks allow air to reach depth. Aeration, usually done by ploughing the field, happens naturally.

- It has a high water retention ability. Hence, it is suitable for cotton cultivation. (Note: cotton grows in dry areas because a dry climate is required for boll formation, but roots need a good water supply, which is ensured by the high clay content of black soil) .

- They are found in

- Maharashtra and Malwa plateaus,

- Kathiawar peninsula

- Kaimur hills

- Telangana and Rayalaseema region of Andhra Pradesh

- Northern part of Karnataka

- Crops grown in it include Cotton (most important), Millet, Tobacco and Sugarcane.

3. Red Soil

- 28% of the total area of India consists of Red soil.

- These soils have been formed by the disintegration of ancient crystalline and metamorphic rocks like granites and gneisses.

- The red colour of these soils is due to the presence of iron.

- Their texture is sandier and less clayey.

- Chemical composition

- They are rich in iron, magnesium, aluminium and potash.

- But they are deficient in humus, nitrogen and phosphorous.

- They practically encircle the entire black soil region of the Deccan plateau on all sides and are found in

- Whole of Tamil-Nadu,

- Parts of Karnataka

- North-east Andhra Pradesh

- Orissa

- South Bihar,

- eastern Madhya Pradesh

- North-eastern hilly states.

- Aravalli mountain regions of Rajasthan.

- They are found in arid regions with low rainfall. But under irrigation, these soils provide good production with the application of ammonia, superphosphate, and compost fertilizers.

- Since they are rich in magnesium, iron and aluminium, so can produce excellent crops like bajra, pulses, cotton, tobacco, jowar and fruits.

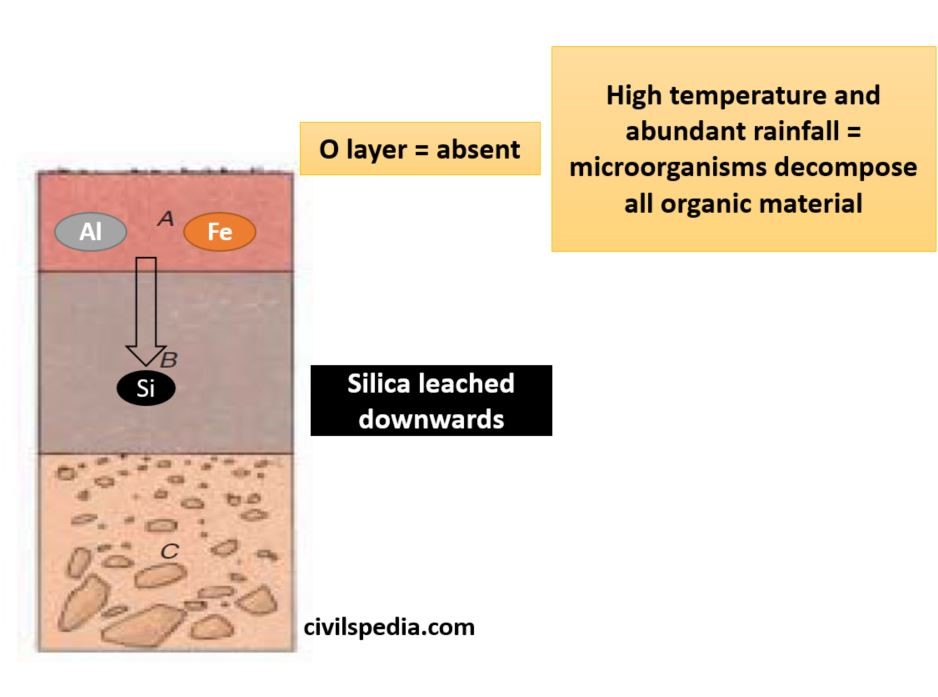

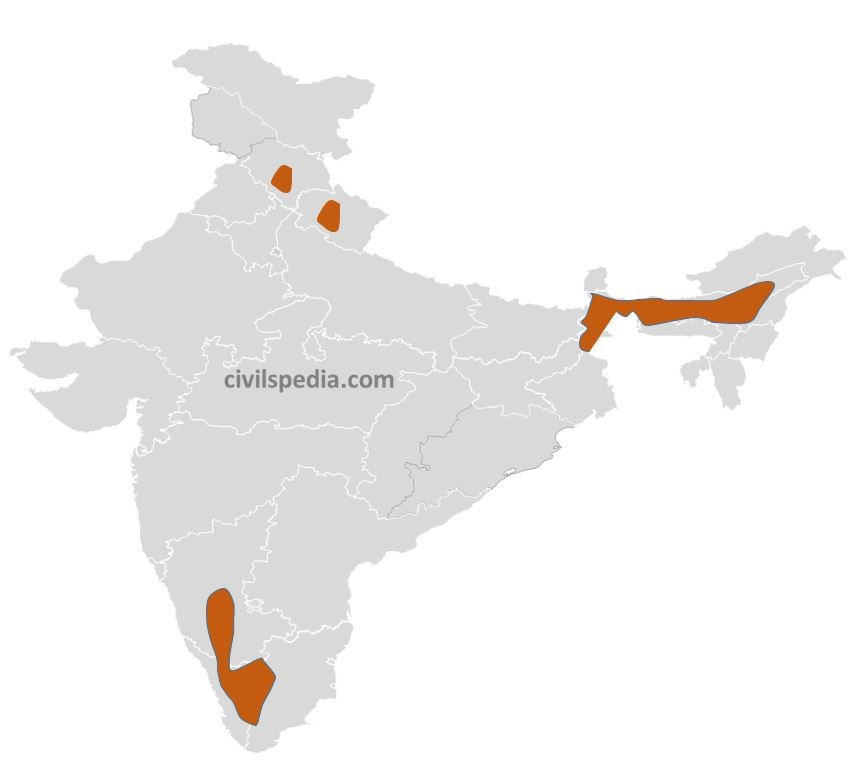

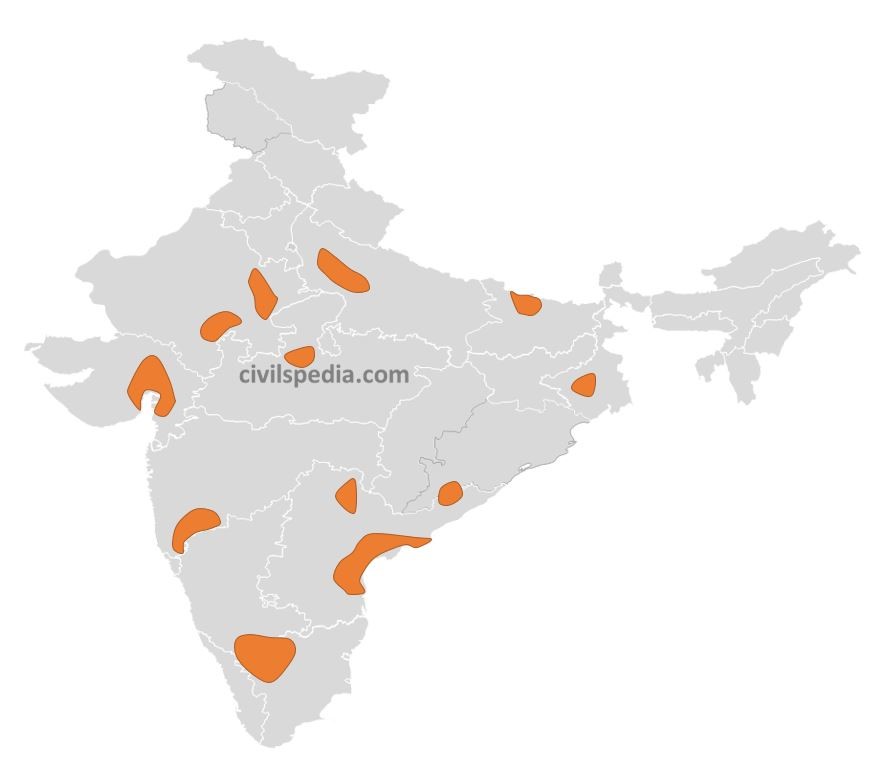

4. Laterite Soil

- 2.62% of the total area of India consists of laterite soil.

- These are soils of warm wet tropical regions, where due to heavy rain (more than 200 cm), lime, silica and salts are leached away, and oxides of iron and aluminium are left behind.

- The word laterite means brick type. It is named so because it hardens like Brick when dry. However, it is soft when it’s wet.

- They are red in colour due to the presence of Iron oxide.

- Their texture is heavy loam and clay.

- Chemical Composition

- They are rich in Iron and Aluminium oxides and hence are acidic.

- But they are poor in nitrogen, lime, potash, phosphorus and organic matter. The Humus content of the soil is removed fast by bacteria that thrive well in high temperatures.

- These are found on

- Hills of Satpura and Vindhya

- Eastern Ghats region of Orissa,

- Hills of Western Ghats of Karnataka

- South Maharashtra

- Malabar in Kerala

- North & Eastern parts of the Shillong plateau in the northeastern states

- It is not very suitable for agriculture because of its high iron content. But it is suitable for crops that need iron for growth, i.e. Tapioca, Cashew nuts, Coffee and Rubber.

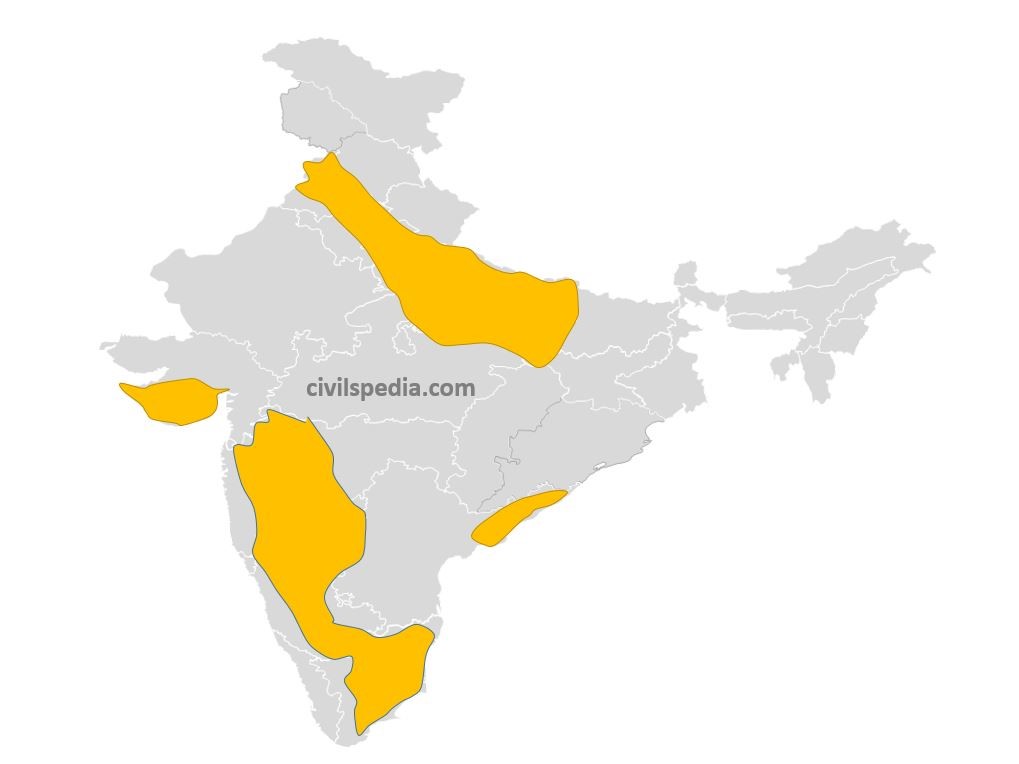

5. Arid and Desert Soils

- 6.13% of the total area of India consists of Arid and Desert Soils.

- They are also called Sierozem soils.

- They are formed under arid & semi-arid conditions, high temperatures and accelerated evaporation when the soil becomes dry.

- Their texture is sandy.

- Chemical Composition

- They contain a high proportion of salts

- But they are deficient in humus, nitrogen & moisture.

- As a result of the “Kankar” layer formation in the bottom layers, water infiltration doesn’t happen. But in case water is made available by irrigation, the soil moisture is easily accessible to the plants their sustained plant growth

- They are found in

- Rajasthan

- Northern Gujarat

- Southern Punjab and Haryana (Desert soil reaches here from Rajasthan under the influence of sand storms, in the form of ‘Bhur’ soils)

- With irrigation facilities, crops like bajra, jowar, cotton, wheat, sugarcane, and some vegetables can be grown.

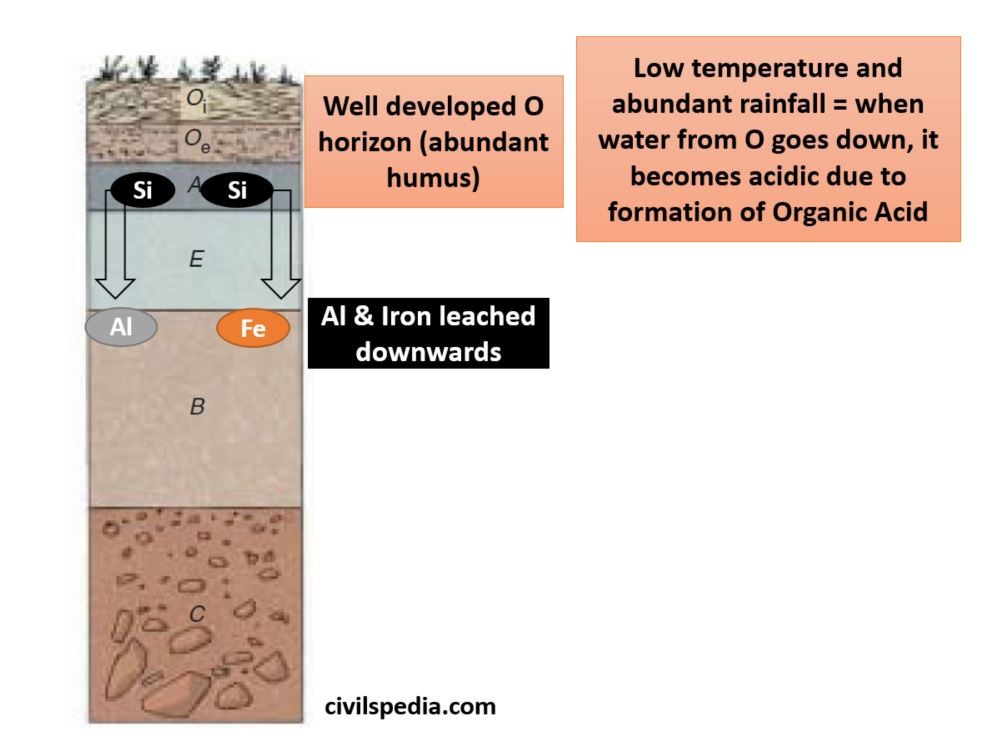

6. Forest and Mountain Soils

- 7.94% of the total area of India consists of Forest and Mountain soil.

- As the name suggests, this type of soil is found in the mountains.

- The thickness of the upper layer is very low on mountain slopes, although it can be up to 2 metres in valleys and gently sloping hillsides. These are less developed immature soils.

- Their colour and character change with height.

- Up to an elevation of 1800 metres: brown-coloured, acidic forest soils are found due to the decomposition of deciduous vegetation.

- Between 1800 and 3000 metres: Low temperatures and poorly decomposed coniferous vegetation convert these soils into grey-brown podzolic soils.

- Above 3000 m: Alpine meadow soils occur above the timberline. These are shallow, dark in colour and sandy-loam or sandy-silica in texture. The organic matter is not decomposed in these soils due to a sharp fall in temperature.

- These are found in

- Lower and middle ranges of the Himalayas, especially in Assam, Ladakh, Lahaul –Spiti, Kinnaur, Darjeeling, Dehradun, Almora, Garhwal etc

- Nilgiri hills in the south.

- These soils can be used to grow Coffee, tea, maize, potato, fruits and various types of spices

- Apart from that, forestry and lumbering activities are also done here.

7. Saline and Alkaline Soils

- 1.29% of the total area of India consists of Saline and Alkaline soil.

- They are also known as Usara soils.

- These soils can be formed due to many reasons in

- In the interior areas, saline soils originate due to bad drainage, over-irrigation or canal seepage. It causes water logging, and the capillary action transfers injurious salts from the subsurface to the topsoil.

- In dry agricultural areas, relying on excessive irrigation. Such conditions promote capillary action resulting in the deposition of salts in the top layer.

- In coastal areas, saline soils form due to Sea water intrusion.

- Their structure ranges from sandy to loamy.

- Chemical Composition

- They have excessive amounts of sodium, potassium & magnesium. It makes such soils infertile, and they can’t support vegetative growth.

- They lack nitrogen and calcium.

- They are found in

- Deltas of the Eastern coast, Sundarbans of West Bengal and Western Gujarat due to seawater intrusions

- Areas of Green Revolution like Punjab (locally called Kallar or Thur), Haryana and Uttar Pradesh

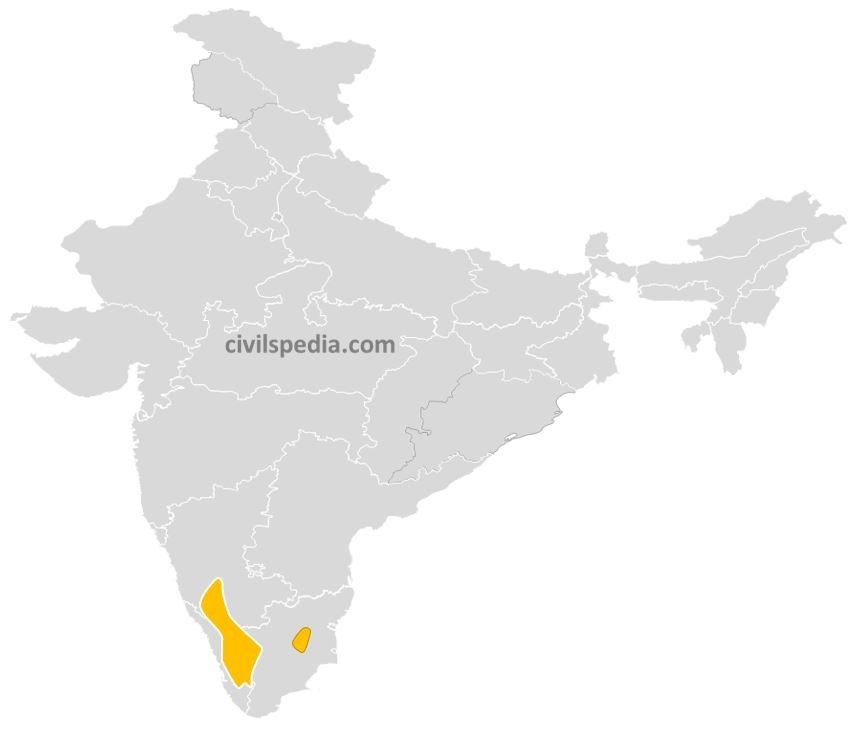

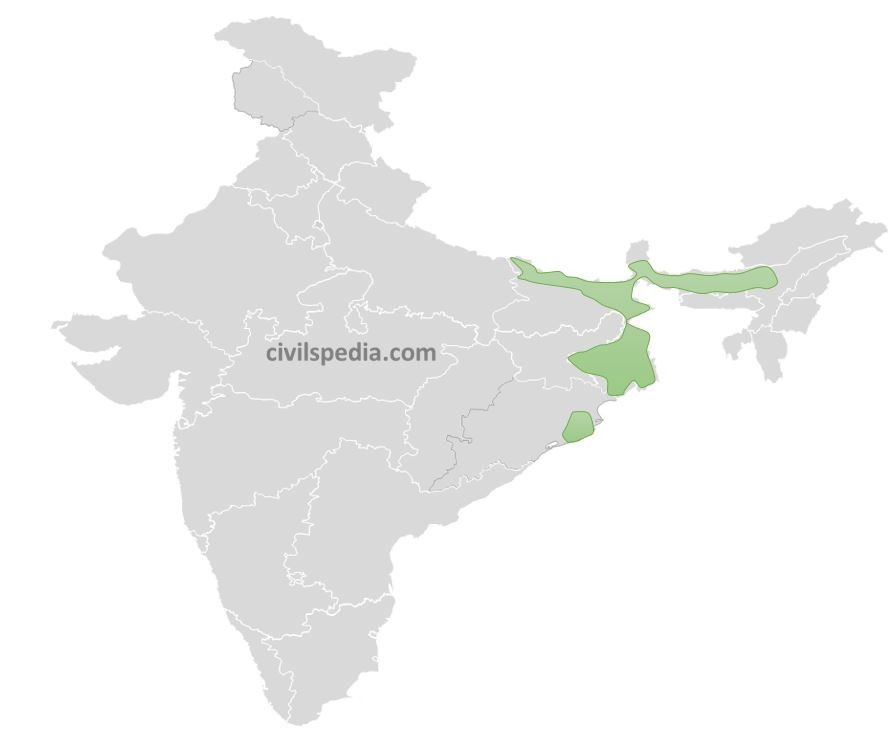

8. Peaty and Marshy Soil

- 2.17% of the total area of India consists of Peaty and Marshy soil.

- Such soils are found in areas with heavy rainfall, high humidity, and good vegetation growth. Hence, excessive dead organic matter is present in such areas, providing humus and organic content to the soil. Organic matter in such soils can range between 40 to 50 per cent.

- This soil is heavy and black in colour.

- They are found in

- Sundarbans Delta

- Coastal areas of Orissa

- South-Eastern coastal parts of Tamil Nadu

- Central Bihar

- Almora district of Uttar Pradesh