Last Updated: Feb 2025 (Digital Banking)

Table of Contents

Digital Banking

This article deals with ‘Digital Banking / Cashless Economy.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

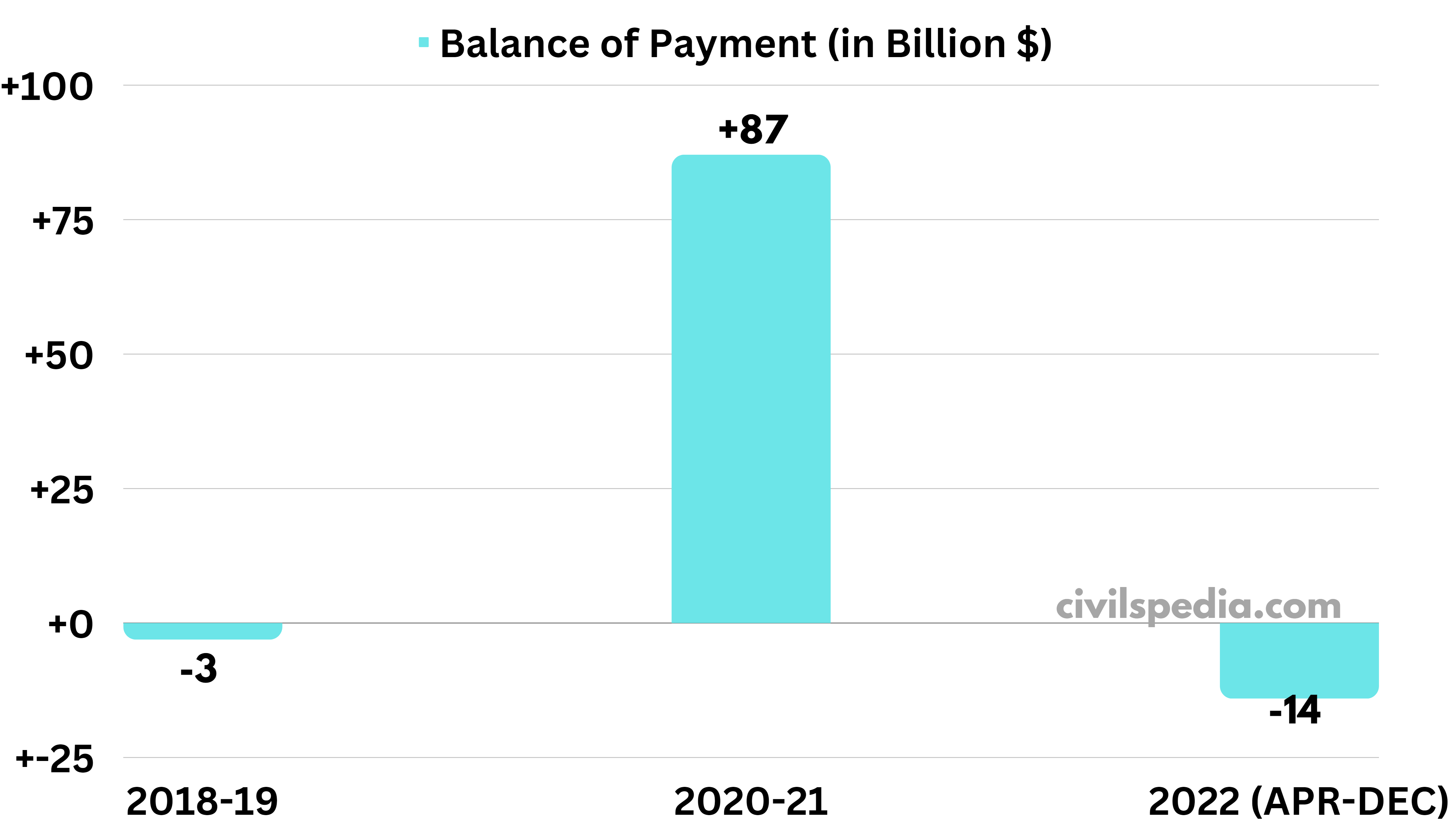

Indian Case: More Cash in Circulation

India uses too much cash for transactions. The ratio of Cash to GDP in India is one of the highest in the world

Pros and Cons of Cashless Economy

Pros of Cashless Economy

- Control Tax Evasion: It will be challenging to evade taxes as all transactions can be tracked in a cashless economy. Money laundering, black money and terrorist financing can be easily controlled.

- No fear of Physical Theft: In Sweden, where 50% of transactions have gone cashless, robberies have fallen to 30 years low because people don’t have any cash.

- Cash transactions in small denominations can happen easily. One can pay even a single paisa (or cent).

- Curb the menace of Counterfeit Currency: No issue of counterfeit currency and wearing and tearing of currency notes.

- Positive Examples: The Cashless Currency is working fine in Sweden & Norway, where 50% of transactions have gone cashless.

- Cash Currency is Expensive: Ratan Watal Committee (2016) quoted that the dependency on cash costs the country about ₹1 Lakh crore on account of the cost of printing new currency, operating currency chests, maintaining supply to ATM networks etc.

- Building Credit History: If small vendors start to take payment via digital means in Bank Accounts, their credit history will develop, and they can use this to get credit from institutional lenders.

Cons of Cashless Economy

- Extreme Surveillance: Every payment is traceable. This hands over enormous power in the hands of the government, which can carry out Orwellian levels of surveillance.

- Exclusion Issue: It can lead to the exclusion of segments of the population who are slow to embrace new technologies, especially the elderly.

- Vulnerability to Fraud: The problem of electronic fraud increases and the whole system can be hacked.

- Cashlessness may produce a peculiar human problem as people are sentimental about coins and notes.

- For payment to happen cashlessly, infrastructure is required at point-of-sale destinations that small businesses can’t afford.

- Ultimately, digital payment costs are borne by consumers even when they are charged from producers or vendors. Charges can range from 0.1 per cent to as much as 4 per cent of the value of the transaction.

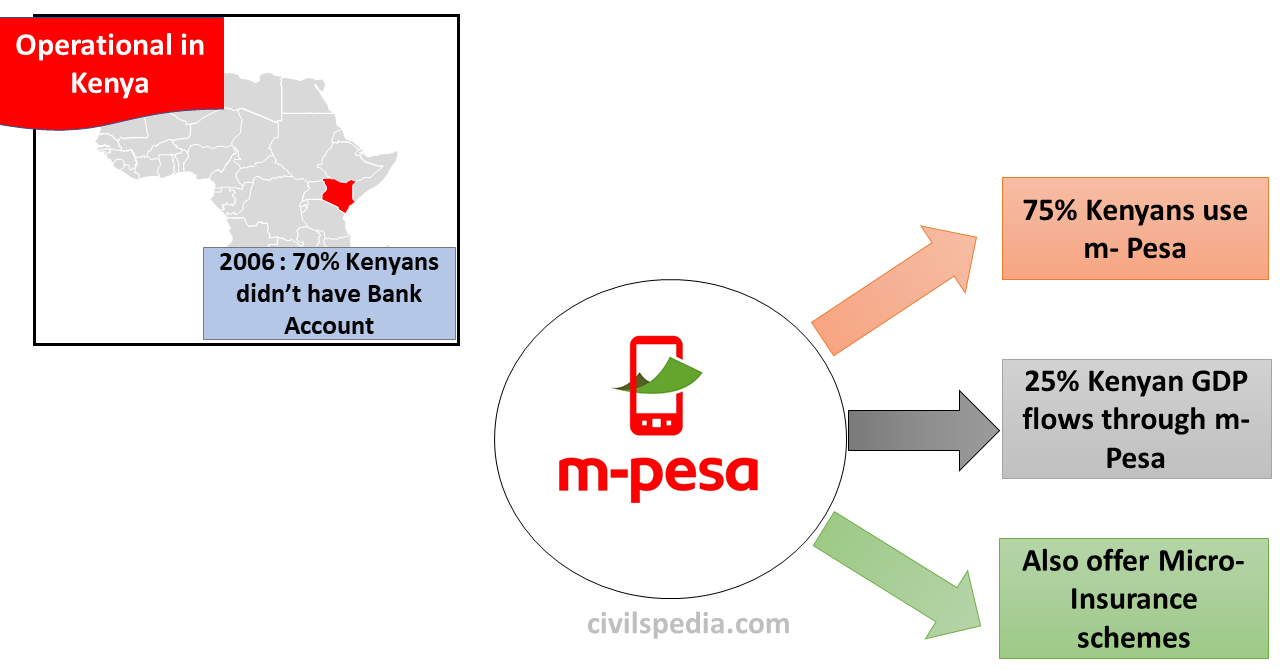

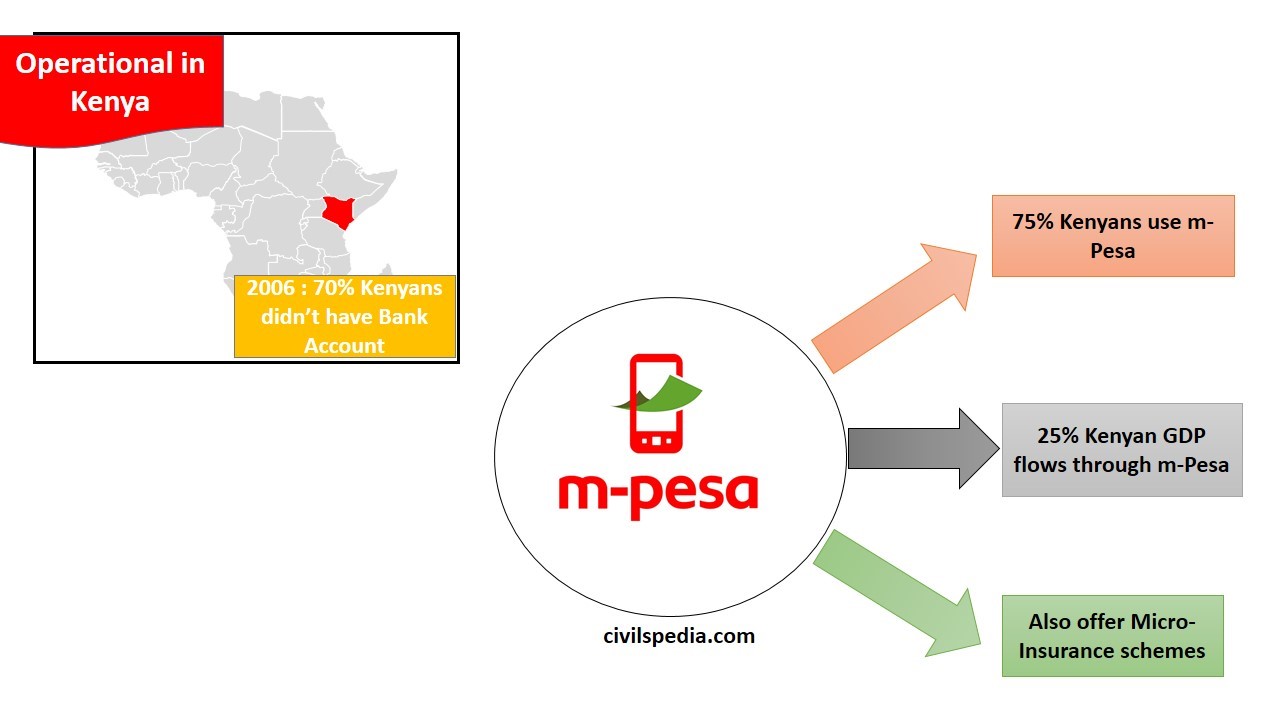

International Case Study: mPesa

In Kenya, M-PESA in partnership with Vodafone’s local operator Safaricom has ushered Cashless Revolution.

Problems in the adoption of Digital Payment in India

As seen by Chandrababu Naidu Committee & Ratan Watal Committee, problems associated with Digital Payment in India are

1 . Lesser Points of Sale

- India has 160 ATMs per million (UK = 1000 / million)

- India has 1000 Point-of-Sale (PoS) per million (UK = 30,000 / million)

2. MDR Issue

- MDR = Merchant Discount Rate

- Banks charge around 2% from Merchants for providing Cashless Payment Services. Due to this, the profit margin of merchants decreases. It restricts the adoption of digital payment by Merchants.

3. KYC norms for Point of Sale Devices

- Vendors cant buy Point of Sale devices as they don’t have any permanent address.

4. Interoperability

- There is no interoperability between different payment systems (Eg: PayTM to PhonePe) and between different Financial Institutions (Eg: SBI to PayTM).

5. Regulatory Problems

- The Banking Ombudsman doesn’t have the required powers to deal with Internet Banking Frauds.

- IT Act is not comprehensive enough to deal with such financial frauds.

6. The Government doesn’t act as a Role Model

- Although the Government is promoting a Cashless economy, one can’t pay taxes via mobile wallets like PayTM, and bidding fees for various e-Tenders are to be paid in cash (only). Hence, the Government doesn’t act as a role model.

7. Low Digital Financial Literacy

- People aren’t aware enough to handle a cashless payment system.

8. Behavioural Issue

- Changing behaviour to use cashless transactions is a complex process.

Issue: Interoperability

- Interoperability is the ability of customers to transact across commercially and technically independent payment platforms.

- Due to legal complications under the Payment & Settlement System Act of 2007, users don’t have full interoperability i.e.

- Users can’t transfer money from one wallet to another (can’t transfer money from Paytm to Phonepe).

- Users can’t use wallets to pay all types of taxes, fees, insurance premiums etc.

- It acts as an obstacle to the ‘cashless economy’.

In 2018, RBI issued guidelines for interoperability with the Know Your Customer check, customer grievances redressal mechanism etc., so that transactions can be made between different platforms.

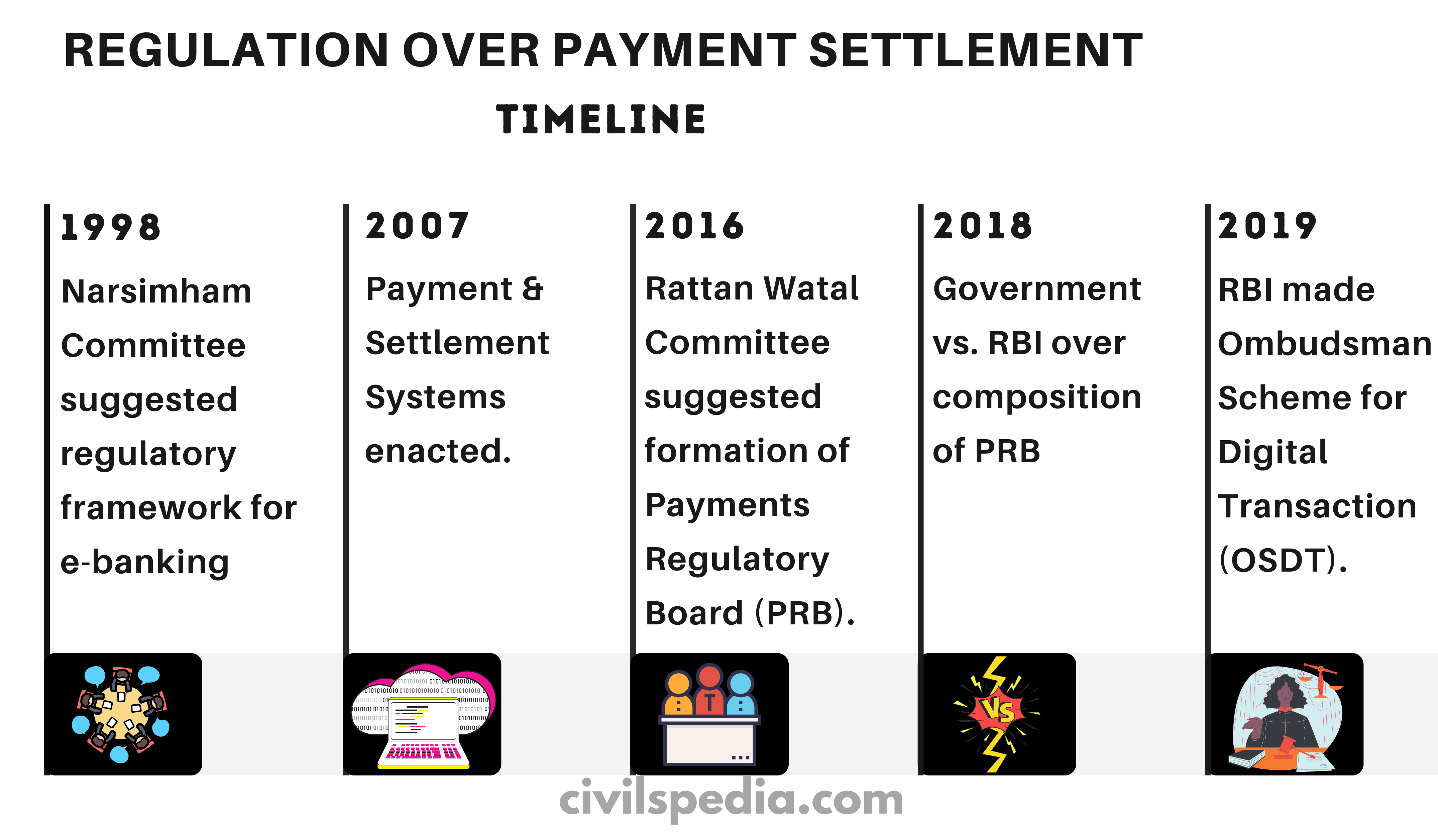

Issue Analysis: Regulation over Payment Settlement

- 1998: Banking Reforms / Narsimham-II Committee suggested a regulatory framework for e-banking, card payment etc.

- 2007: Payment & Settlement Systems Act enacted according to the recommendations of Narsimham Committee under which RBI supervises e-banking, card payment, and other digital money-related issues through Board for Regulation and Supervision of Payment & Settlement Systems (BPSS). All Payment System providers have to register with RBI’s BPSS – whether a bank, non-bank, wallet-PPI etc.

- 2016: Ratan Watal Committee on digital payment suggested replacing BPSS with a Payments Regulatory Board (PRB) in RBI to regulate Interoperability, Consumer protection, Innovation, R&D in digital payments (as BPSS looks after only Payment and Settlement).

- 2018: RBI opposed the formation of the Payments Regulatory Board due to differences with the government over the issue of who should be Chairman, how many members should be from the Government side etc.

RBI made Ombudsman Scheme for Digital Transactions (OSDT) in 2019 with the following functions

- To look into matters of Digital Payment like Consumer Protection.

- The consumer can make a free complaint about matters up to Rs 20 lakh against Mobile Wallets, Payment Payment Instruments (PPI) and other digital transactions.

- It can charge a penalty of up to Rs 1 lakh for the victim for their mental agony, loss of time etc.

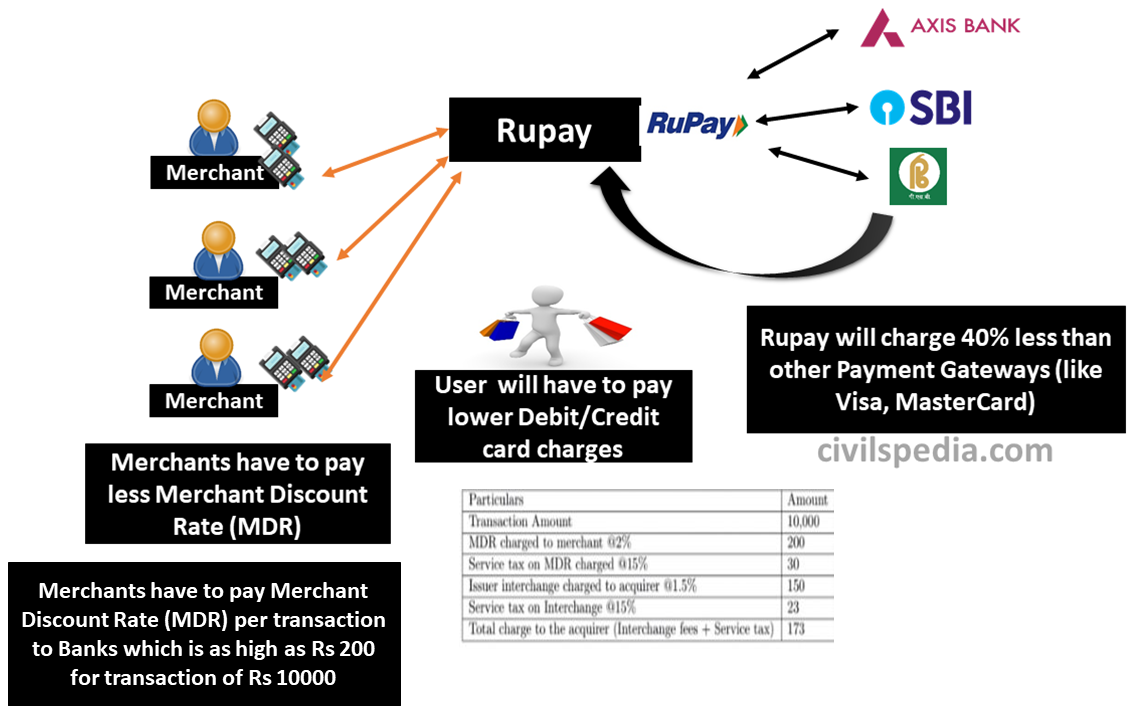

Issue Analysis: Merchant Discount Rate (MDR)

- MDR is the merchant’s fee paid to a bank for every credit/debit card transaction.

- MDR hurts merchants’ profit margins and discourages them from adopting Point of Sale terminals, a digital payment system.

- 2017-18: RBI put ceilings on MDR fees to encourage the digital economy.

- In 2019, the government announced that no MDR would be charged from a firm whose annual turnover is less than Rs 50 crore. RBI and Bank will absorb this burden for not handling so much money.

Developments Related to Cashless/Less Cash Economy

1. Suggestion of various committees to promote the Cashless Economy

1.1 Ratan Watal Committee

- Formed in December 2016.

- To suggest Medium Term Recommendations to strengthen the digital payment ecosystem in India.

Recommendations of Ratan Watal Committee

- Form a separate Regulator for Digital Payments under RBI known as Payments Regulatory Board.

- The committee envisaged a prominent role for Aadhaar as the primary identification for (KYC) purposes.

- Government departments should levy a cash-handling charge to discourage cash transactions.

- Give incentives like discounts to consumers to make cashless payments.

- It also suggested interoperability between banks and non-bank digital payment gateways.

- Rewards for government departments, state governments, districts, and Panchayats to promote digital payments.

- Create a fund proposed as DIPAYAN from savings generated from cash-less transactions to expand digital payments.

- Reduce or eliminate import duty on the import of ATMs & Point of Sale machines.

1.2 Chandra Babu Naidu Committee

- Formed in Nov 2016 & submitted a report in Jan 2017

- Name of Committee: Chief Minister’s Committee to promote Digital Payment in India by NITI Aayog.

Recommendations

- Tax incentives should be given for domestic production of Point of Sale machines & ATMs.

- Banks should charge 0% MDR from Government Bodies like Railways, Electricity etc.

- Develop a Common QR based payment system for Vendors (led to the formation of BHARAT QR).

1.3 Nandan Nilekani Committee

- In Jan 2019, RBI appointed Nandan Nilekani Committee to suggest ‘how to deepen the digital payments’.

- Its main recommendations were

- Give tax incentives to companies using digital payments.

- Reduce the taxes on devices required for digital payments.

- Raise awareness about BHIM-UPI.

- Setup Computer Emergency Response Team for Finance (CERT-Fin).

- Prepare area-wise ‘Digital Financial Inclusion Index’ to monitor progress.

2. Schemes to promote Cashless System

2.1 Rupay Card

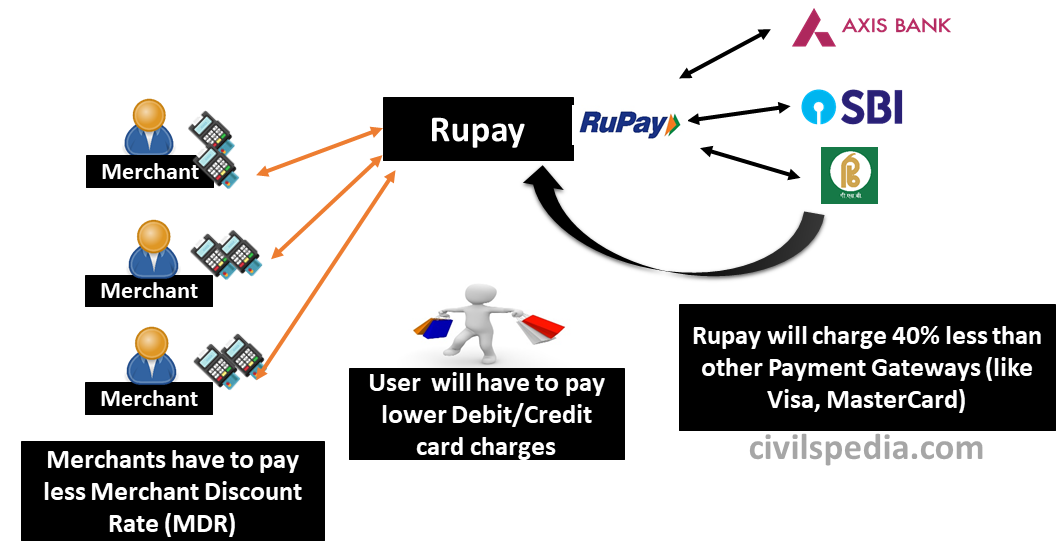

- RuPay is the Payment Gateway started by the National Payment Corporation of India (NPCI).

- It aims to increase financial inclusion by decreasing the operating cost of Banks to service their customers using debit & credit cards.

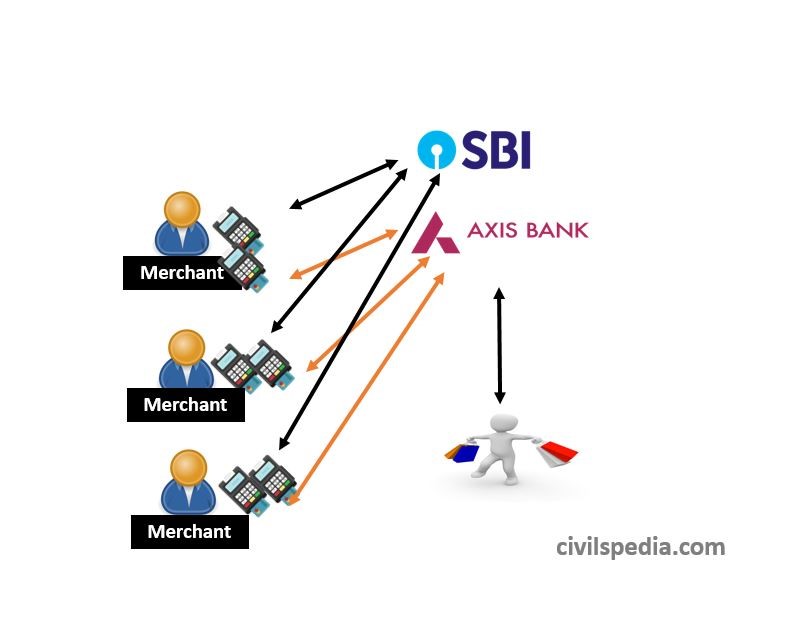

How Payment Gateway system work?

Case 1: If there is no payment gateway

- Each bank has to tie up with merchants separately.

- It leads to duplication of effort.

Case 2: In presence of payment gateways

- Each bank can tie up with a payment gateway & the payment gateway will tie-up with the merchants.

Banks are paying ₹300 cr per year to payment gateways (Banks charge them from Merchants as Merchant Discount Rate (MDR) per transaction)

What Rupay will do?

- Rupay will do the same work at 40% lower rates. Hence, the user will have to pay lower Credit/ Debit card charges, and Merchants will have to pay lower Merchant Discount Rates to the banks.

- Rupay is the 7th payment gateway in the world.

- 3 channel payment can be made using this: ATM, PoS (Point of Sale) and Online.

- Under Jan Dhan Scheme, Rupay Debit Card is given to the customers.

2.2. FastTag

- FASTags are prepaid rechargeable tags for automatic toll collection at toll collection booths using RFID technology.

- It helps in faster mobility by solving the issue of Jams at toll booths. It is also a step in the direction of a cashless economy.

- From 15th January 2020, it is mandatory for all vehicles passing through tolls to have FASTags.

2.3 Payment Infrastructure Development Scheme (PIDF)

- PIDF aims to strengthen digital payment infrastructure across Tier-3 to Tier-6 cities, focusing on the North-Eastern States.

- PIDF will subsidize merchants, street vendors, artisans etc. for deploying digital payment systems like Point of Sale (PoS) terminals, a QR-based payment system, etc.

- The scheme was started on 1st January 2021 for 3 years. Subsequently, the government has extended it for another 2 years till 31 Dec 2025.

2.4 Scheme For Financial Support To Digital Payments

- It is an incentive scheme for promotion of RuPay Debit Cards and low-value BHIM-UPI transactions (person-to-merchant or P2M)

- It is an initiative of Ministry of Electronics and Information Technology with the financial outlay of ₹ 2,600 crore.

- Banks will be provided financial incentive for promoting Point-of-Sale (PoS) and e-commerce transactions using RuPay Debit Cards and low-value BHIM-UPI transactions (P2M).

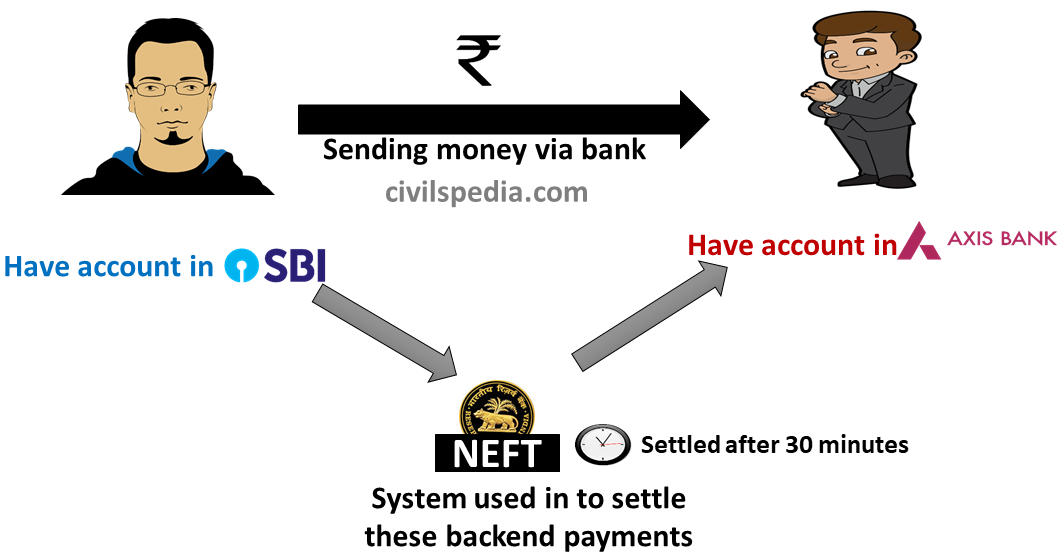

2.5 NEFT System

- Using a bank, a person can settle the amount with another person even if they have a bank account in another bank. The NEFT (National Electronic Funds Transfer) system is used in the backend to settle these payments.

- NEFT settles the net amount between banks at the interval of 30 minutes. After 30 minutes, it will check the lakhs of transactions made between particular two banks throughout the country and settle the remaining amount between two banks.

- RBI operates this system.

- Using this system, transactions of up to ₹10 lakhs can be made.

- After the 2021 update, even Prepaid Payment Instruments such as AmazonPay, Mobikwick etc., can use the NEFT system.

2.6 White Label ATMs

- White Label ATMs are operated by private non-banking companies that own & operate their brand of ATMs.

- All the other Bank ATMs can use these White Label ATMs & get service but at a nominal charge.

- It is a step towards financial inclusion. ATM penetration will increase because of this.

- E.g., Tata’s Indicash, Muthoot Finance, Srei Infra, Vakrangee Software, Prizm Payments etc.

2.7 Schemes by NPCI

NPCI is a not for profit company made by 10 promoter banks in 2008 to provide cost-effective payment solutions for banks

NPCI is running various initiatives related to high-end technology in Banking & Payment Systems.

Initiatives of NPCI

1. UPI

- UPI = Unified Payment Interface

- It was started in 2016.

- It is a technology for building digital payment apps (i.e. UPI is not an app but technology made by NPCI, which banks use in their apps).

- Features provided by UPI

- Scan the QR Code and pay directly to the merchant’s account.

- Link your bank account to directly transfer money from your bank account without storing it in an e-wallet first.

- The facility of ‘push transaction’ (e.g. Sending Remittances to family).

- The facility of ‘pull transaction’ (e.g. Cable operator sending a request for the monthly bill within the app).

- The facility of Bill sharing.

- Overdraft facility

- Cash on Delivery

- User mandate for a future date, e.g. DTH

- Invoice in the inbox

- It can also be used in Basic Phones (i.e. Non-Smartphones) using 123 Pay

- Examples of UPI-based apps: are SBI Pay, AxisPay, PhonePe and NPCi’s BHIM.

UPI Lite

- Users can add money from their bank account to UPI lite Wallet on their mobile app (such as the BHIM app or Google Pay).

- The user can use money stored in the UPI Lite wallet to settle transactions without requiring a PIN.

- The maximum amount that can be used per transaction is Rs. 500, and the maximum amount which can be stored in the UPI Lite wallet is Rs. 2000.

- UPI Lite helps make transactions faster, and there are fewer chances of transaction failures when the server of the bank is facing issues.

Internationalisation of UPI

- In 2022, Nepal became the first foreign country to adopt the UPI system. UPI is now accepted in Nepal, Bhutan, Singapore, UAE, Oman, Sri Lanka, Mauritius and France.

- In 2024, France became the first European country where UPI is accepted.

- Project Nexus: RBI has joined this international initiative, which aims to connect Fast Payment Systems like India’s UPI and the UAE’s Instant Payment Platform (IPP).

- UPI has changed the digital payment landscape in India as UPI’s share in the total digital transaction in India is continuously increasing.

Side Topic: Unified Lending Interface (ULI)

- ULI is proposed by the RBI Governor to revolutionize the lending ecosystem in India (similar to UPI for payments)

- Issue it intends to solve: Currently, Lending Institutions cannot make quick credit appraisals as the data required for this are stored with different entities, such as banks, the government, credit information companies, etc.

- ULI will facilitate the seamless flow of information between these institutions so that the Lending Institution can make a quick decision regarding credit appraisal, especially for small and rural borrowers.

- API of ULI can be easily integrated into apps and websites in the Plug and Play Model.

2. e-RUPI

- The issue to be solved:

- Poor and rural populations don’t have bank accounts.

- Money given by the government, even in a well-targeted way via Direct Benefit Transfer, can be used by the beneficiary for any other purpose.

- e-RUPI is a QR-based purpose-specific digital voucher where it is not required for the customer to have a bank account and is operable on basic phones, even in areas that lack an internet connection.

3. Bharat QR Code

- It was started in Feb 2017.

- Bharat QR code has been developed jointly by the National Payments Corporation of India (NPCI), Visa, MasterCard and American Express under instructions from the Reserve Bank of India (RBI).

- Note – QR is a two-dimensional machine-readable matrix. QR Code can store up to 7089 digits compared to conventional bar codes that can store a max of 20 digits.

Advantages

- It eliminates the need to use card-swiping machines for digital payments. There is no need to have ‘Swiping Machines’ in shops. Just have QR printed & payments can be easily done via that.

- Interoperability: Using the BharatQR code, the merchants will be required to display only one QR code instead of multiple ones.

- For the buyer, there is no need to carry a card. Payment can be made via mobile.

4. Aadhar Enabled Payment System (AePS)

The customer has to tell the Aadhar number and name to the merchant or Bank Business Correspondent, who authenticates it using the customer’s fingerprint. Following this simple step, his transaction is completed.

5. Cheque Truncation System (CTS)

- If somebody from Delhi gives a Cheque from the Delhi Bank Branch to a person in say Chandigarh. Earlier, that cheque was physically sent to Delhi Branch for settlement.

- Under CTS, a Scanned image of the cheque can be sent to Delhi Branch, and settlement can be done rapidly.

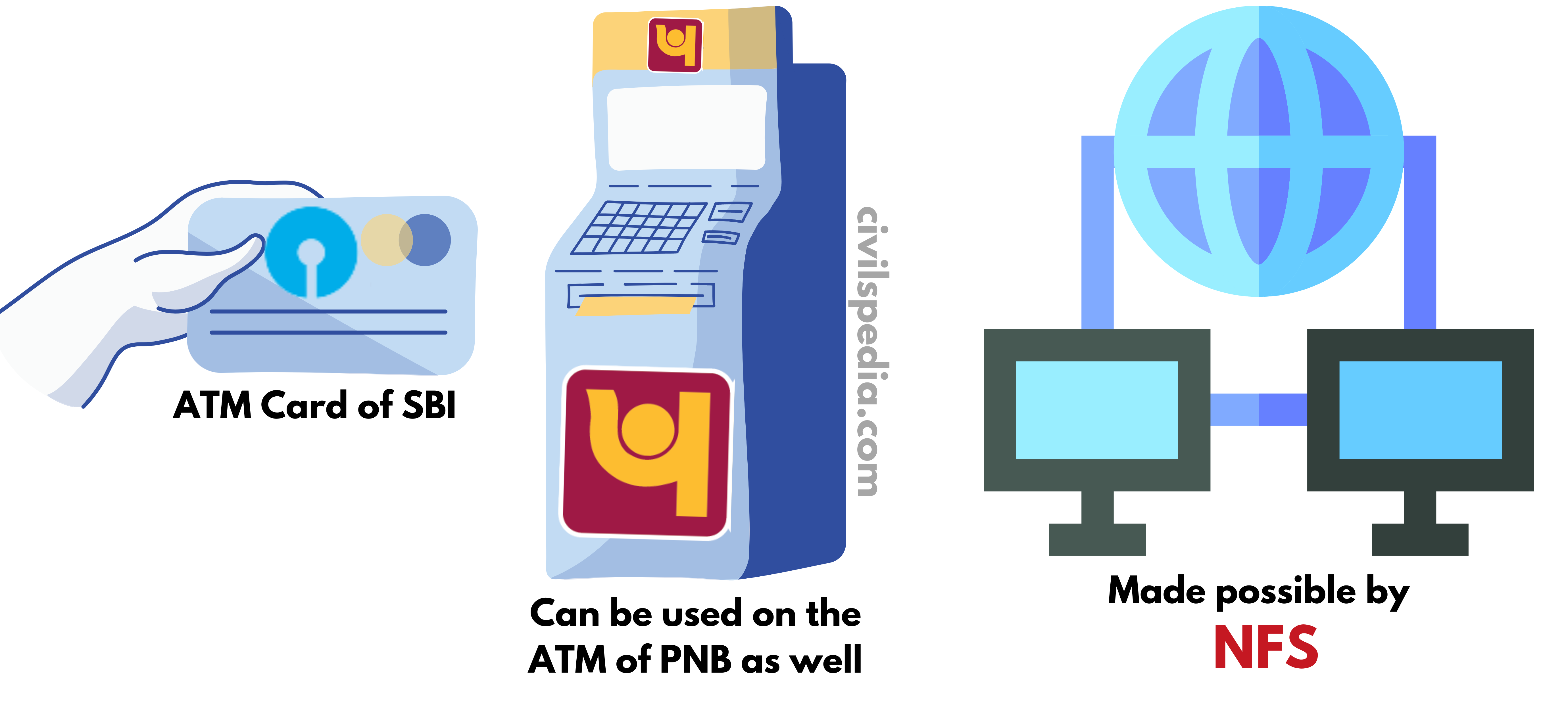

6. National Financial Switch (NFS)

- ATM Card of one Bank can be used in other Banks too. The system that is working in the backend to make this possible is NFS.

- NFS helps re-route transactions to the Core Banking Solution Network of the Bank whose ATM card is being used.

7. NACH (National Automated Clearing House)

- NACH helps with Automated Payments, which are to be paid periodically, like each month or year, e.g., salaries, bills, EMI etc.

- NACH is finding great attraction among customers, companies and government departments to pay bills, EMIs, salaries, pensions etc.

8. IMPS

- IMPS = Immediate Payment Settlement System

- It is available 24X7.

- It is used for real-time settlement of all online payments up to Rs. 5 lakh.

- It is not free. A service fee is charged on the transactions.

9. Bharat Bill Payment System (BBPS)

- BBPS is an initiative of NPCI.

- It builds an interoperable service through a network of agents to facilitate all types of bill payments through different modes and instant generation of payment receipts.

10. Offline Retail Payments using Card and Mobile Devices

- RBI has allowed offline payment using the card and mobile devices to deal with the issue of internet connectivity.

- The maximum transaction allowed under the scheme

- Rs. 200 per transaction

- Subject to an overall limit of Rs 2000 (after that person will have to go online to settle the transactions)

2.8 Lightweight Payment and Settlement System (LPSS)

- The Lightweight Payment and Settlement System (LPSS) is developed by RBI as an alternative backup to existing platforms of payment and settlement, such as NEFT, IMPS, RTGS, etc., during an emergency such as a natural disaster or war.

- The system is designed to be lightweight, meaning it does not require heavy infrastructure or large teams to function.

Side Topic: ATM security features introduced to prevent frauds

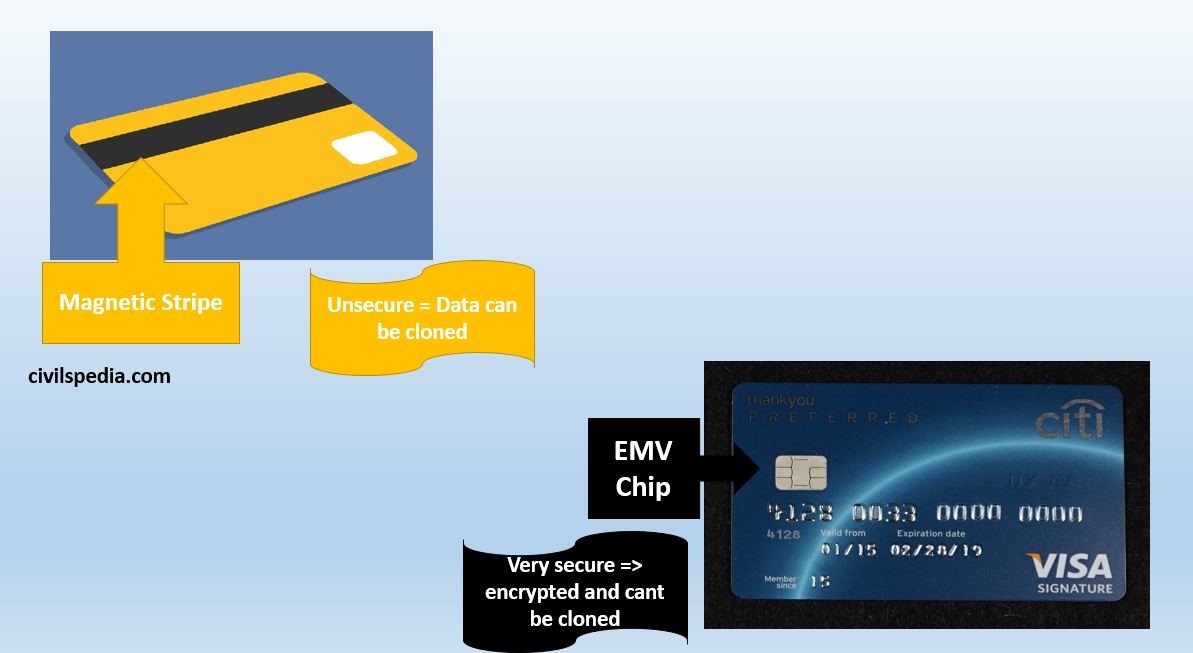

1. ATM Card Technology changed to EMV Technology

Magnetic Technology

- Magnetic Technology used in the ATMs has been used since the 1960s.

- In this, data is stored on the magnetic strip. But it is insecure as the data can be duplicated, cloned, skimmed while swiping the card, which increases the chances of fraud.

- So, RBI stopped such cards from 1/1/2019 using the Payment & Settlement Act powers.

EMV Technology

- Full form: Europay + Mastercard+ Visa

- It is based on chip infrastructure with encryption.

- RBI had ordered migration in 2013. It has become operational on 1/1/2019.

- Two sub-types

- EMV-Contact: cards must remain in the Point of Sale (PoS) Terminal during the transaction.

- EMV-contactless cards: Tap the card on the terminal using RFID technology.

2. Card Tokenisation

- When we shop on sites like Amazon, Flipkart etc. or pay bills using PayTM, they allow us to store our Debit or Credit Card information like Card Number, Expiry date etc., for future convenience. But this thing has security implications in case the server of such a company is hacked, and user information is leaked.

- To prevent such incidents, Card Tokenization was introduced by RBI in Jan 2019. It was fully implemented on 1 October 2022.

- Tokenization = Token number is generated for a given credit/debit card.

- Card customer gives the token number during any type of online/physical shop transaction. His original card number, expiry date, etc., remains hidden from the third party seller.